Are you a financial institution grappling with ACH payment rejections and errors in your NACHA files? Do these issues hinder the smooth flow of your banking operations? If so, then understanding the standard ACH file format would be beneficial. The key to mitigating these payment issues lies in having a solid grasp of the structure, intricacies, and protocols encapsulated within ACH file formats.

ACH or Automated Clearing House files play a pivotal role in the financial ecosystem, acting as a conduit for the transfer of funds between banks and facilitating direct debits from checking or savings accounts. However, these files follow a rigorous structure and format, failing to adhere to which can result in ACH payment rejections, subsequent disruptions in cash flow, and potential impacts on business relationships.

At NachaTech, we aim to demystify the ACH format for you. This article serves as a practical guide that will delve into the essentials of the standard ACH file format, providing you with the knowledge necessary to manage these files effectively and optimize your financial operations.

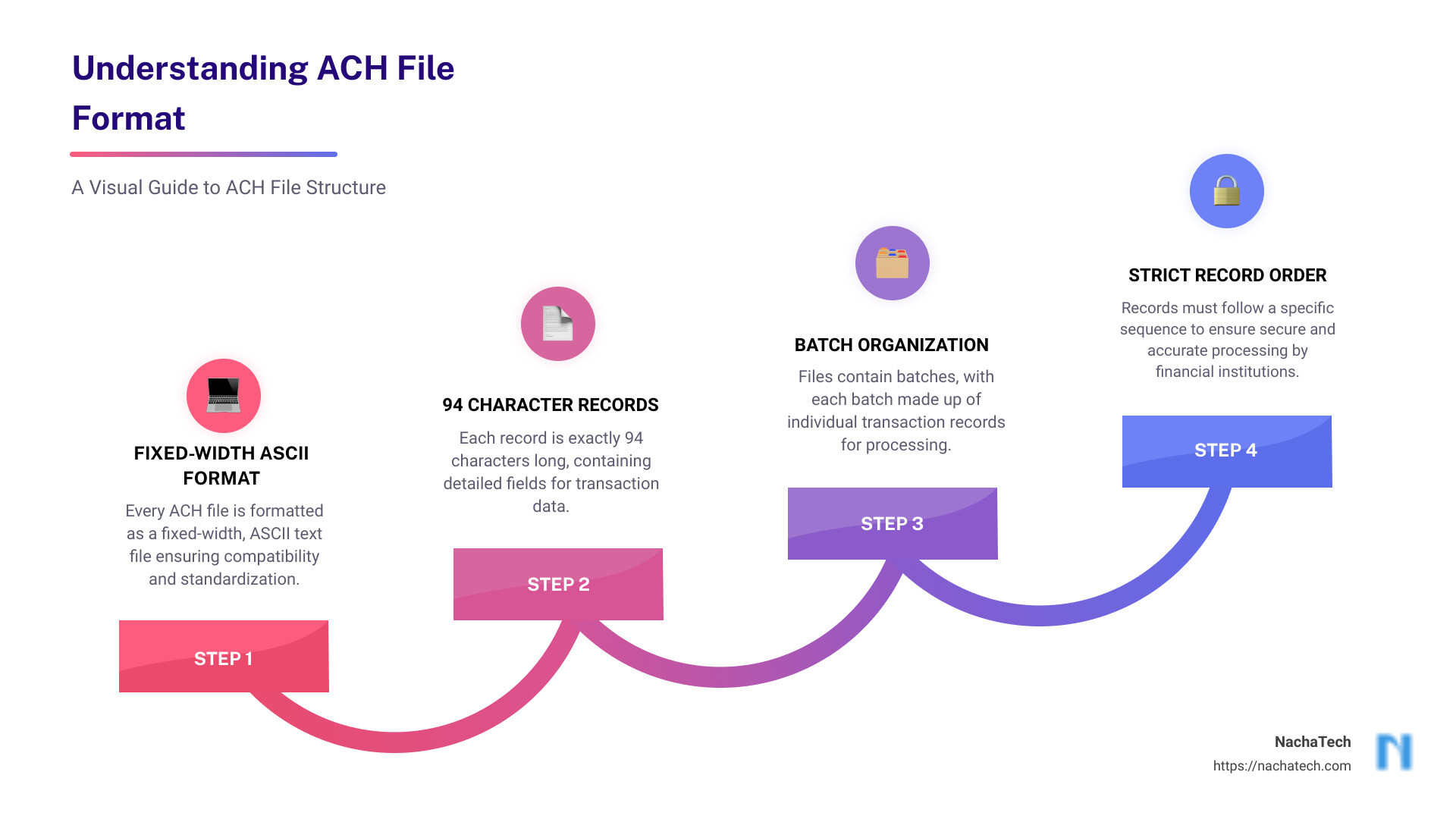

Here’s a quick run-down of what an ACH file format does:

- Stores details required for money transfers between banks in a fixed-width, ASCII file format.

- Each line or ‘record’ in the file is precisely 94 characters long and contains specific ‘fields’ at certain positions.

- The file contains one or more ‘batches’, each consisting of one or more transactions.

- Records in the file must adhere to a specific order to ensure secure and efficient processing of transactions.

Understanding the Structure of ACH Files

To manage ACH transactions effectively, it’s crucial to understand the overall structure of ACH files. These files follow an ‘envelope’ structure that encompasses different elements, including File Headers and Trailers, and Batch Headers and Trailers.

The ‘Envelope’ Structure of ACH Files

The ‘envelope’ structure of ACH files provides a consistent format that aids in efficient processing of transactions. Similar to many financial formats, the file begins with a File Header and ends with a File Trailer, enveloping all the transaction details within these boundaries. Between these ‘bookends’, we find one or more Batches, each beginning with a Batch Header and ending with a Batch Trailer, containing the details of individual transactions.

This organized structure is fundamental to the operation of the ACH Network, as it enables the orderly transfer of information between the Originating Depository Financial Institution (ODFI) and the Receiving Depository Financial Institution (RDFI).

The Importance of File Headers and Trailers

File Headers and Trailers play a vital role in an ACH file. The File Header Record marks the beginning of the file and includes crucial information like the routing number of the originating (sending) bank, date and time stamp, the name of the originating bank, and the company name. This information helps the ODFI recognize which client sent the file and subsequently process the file accurately.

The File Trailer, or the “File Control Record,” ends the file and verifies the integrity of the file by providing various counts (number of batches, number of entries, and so on), sums (debit total and credit total), and a hash total to ensure the file was generated correctly.

The Role of Batch Headers and Trailers

Just as the File Header and Trailer frame the overall ACH file, Batch Headers and Trailers frame individual batches within the file. Each batch starts with a Batch Header Record, signifying the beginning of a batch of transactions.

The Batch Header Record provides identifying details about the originator and describes the type (debits and/or credits) and purpose of all transaction entries within the batch. It also specifies the date the transactions are supposed to post in the Receiver’s account.

Following the Batch Header, the Entry Detail Records contain information about the Receiver, including their account name and account number, as well as the transaction details such as the amount and transaction type (debit or credit).

Each batch ends with a Batch Control Record, which serves as the ‘curtain call’ for each batch, summarizing the transactions within the batch and ensuring that the entries are correct and complete.

At NachaTech, we understand the complexity of managing ACH files and the importance of getting it right. Our tools and software are designed to help you navigate the intricacies of standard ACH file format, ensuring smooth and error-free transactions.

Decoding the ACH File Format

As part of our commitment at NachaTech to help you better manage your ACH transactions, we’ll now delve into the details of the standard ACH file format. This format is critical to ensuring successful transactions and is composed of several key components that you should be familiar with.

The Fixed-Width ASCII Text File

ACH files are essentially fixed-width ASCII text files. This means that each line in the file is precisely 94 characters long, and each character occupies a fixed amount of space within the line. The fixed-width nature of the file allows for uniformity and consistency, which is crucial for automated processing systems like the ACH network. This consistency ensures that every transaction detail is correctly interpreted and processed by the receiving financial institution.

The 94 Character Records

Each line in an ACH file is known as a “record”, and as mentioned earlier, each record is exactly 94 characters long. Each character in a record is assigned a specific position and represents a specific piece of data, also known as a “field”. For example, the first character of each record is known as the Record Type Code, which identifies the type of record (more on this later). The precise arrangement of these fields within each record ensures the correct interpretation of transaction details.

The Role of Record Type Code

The Record Type Code is the first character in each record and plays a vital role in identifying the content of the record. For instance, a Record Type Code of ‘1’ indicates a File Header Record, which provides information about the origin and destination of the file. Understanding the significance of each Record Type Code is essential to managing ACH files effectively.

The Significance of Entry Detail Addenda Record

The Entry Detail Addenda Record is an optional part of the ACH file but plays a critical role when included. It carries additional payment-related information that doesn’t fit within the standard Entry Detail Record. For example, in transactions that require more detailed payment descriptions or require specific reference numbers, the Entry Detail Addenda Record is utilized.

Understanding the structure and components of the standard ACH file format is crucial to effective management of ACH transactions. At NachaTech, we’re committed to helping you navigate these complexities and ensuring that your ACH transactions are processed smoothly and accurately. By providing tools that aid in opening, editing, and validating ACH files, we strive to make your ACH transaction experience as seamless as possible.

The NACHA File Format

In the realm of ACH transactions, the NACHA file format plays a significant role. Named after the National Automated Clearing House Association that developed it, this electronic file format triggers a batch of ACH payments when uploaded into a bank portal.

The Composition of NACHA Files

NACHA files are structured in a specific way to ensure accurate and efficient ACH transactions. Each line in the file is 94 characters long and is structured as alphanumeric ASCII text. The file is formatted in a digital envelope and contains critical payment instructions.

The composition of a NACHA file involves different types of records, each serving a unique purpose. These consist of the File Header Record, Batch Header Record, Entry Detail Record, Batch Control Total, and the File Control Record. Each record contains specific information crucial to the successful processing of an ACH transaction, including company identification, transaction details, and validation checks.

The Role of Standard Entry Class (SEC) Code

An essential part of the NACHA file format is the Standard Entry Class (SEC) Code. This unique code identifies the nature of the transaction, whether it’s consumer or corporate, single-entry or recurring. It also signifies the specific computer record format used to carry the payment and payment-related information relevant to the application.

There are various SEC Codes used for different types of transactions. For example, the code ‘CCD’ is used for Corporate Credit or Debit, ‘CIE’ for Customer Initiated Entries, and ‘IAT’ for International ACH Transaction, among others. Each SEC Code has specific authorization requirements which need to be met for a successful ACH transaction.

The Importance of NACHA File Format Specifications

Following the correct NACHA file format specifications is paramount to prevent payment rejections and errors in ACH transactions. The NACHA file format ensures uniformity, security, and efficiency in monetary exchanges.

Understanding the NACHA file format is not just a luxury but a necessity in today’s digital age. With the rise of electronic transactions, mastering the NACHA file format is key to thriving in the evolving landscape of financial transactions.

At NachaTech, we understand the intricacies of NACHA file format. Our tools are designed to assist you in creating, editing, and validating NACHA files, making ACH file management a less daunting task. We aim to help you master the NACHA file format, eliminating payment rejections, and driving your business towards financial success.

Successful financial transactions don’t just rely on the transactions themselves, but also on the mastery of the tools and systems that facilitate them. And that’s why understanding the NACHA file format is so crucial. Embrace the NACHA file format, understand its structure, and utilize the right tools to manage it.

The CTX Format for ACH Payments

In the sea of ACH payment formats, the Corporate Trade Exchange (CTX) format stands out because of its unique capabilities and benefits. This format is used within a trading partner relationship to transfer funds, either credits or debits. Not only is it versatile, but it also supports a full ANSI ASC X12 message or payment related UN/EDIFACT information.

Understanding the Corporate Trade Exchange Format

The CTX format can handle a remarkable range of transactions. Unlike some other formats, it can support up to 9,999 addenda records. This makes it particularly useful in trading partner relationships, as it allows a comprehensive exchange of information along with the funds transfer.

At NachaTech, we understand that the flexibility and robustness of the CTX format can significantly streamline transactions between businesses. However, mastering this format can be challenging without the right tools and knowledge.

The Role of ANSI ASC X12 Message in CTX Format

One of the factors that set the CTX format apart is its ability to support the ANSI ASC X12 message. This is a universal standard for electronic data interchange (EDI) that allows businesses to exchange standard electronic documents. When used in the CTX format, this feature can facilitate an enhanced level of communication in transactions, allowing for the exchange of payment-related information in a highly structured and standardized manner.

The Use of UN/EDIFACT Information in CTX Format

In addition to the ANSI ASC X12 message, the CTX format also supports UN/EDIFACT information. UN/EDIFACT is the international EDI standard developed under the United Nations. In the context of the CTX format, this means that not only is the exchange of funds facilitated, but also the accompanying information can be sent in a globally recognized and standardized format.

At NachaTech, we believe in harnessing the power of these advanced features to facilitate seamless and efficient ACH payments. Understanding the standard ACH file format and its various nuances, including the CTX format, can be a game-changer in navigating the complex landscape of financial transactions.

As we move towards an increasingly digital future, businesses that can effectively leverage these formats will be well-positioned to thrive. And with our suite of tools and expert knowledge, we’re here to help you do just that.

The Role of ACH Authorization Form

Understanding standard ACH file format is only part of the equation when it comes to managing ACH transactions. Another crucial element is the ACH Authorization Form, an essential component of electronic transactions that can be easily overlooked.

The Importance of ACH Authorization Form in Electronic Transactions

An ACH Authorization Form, also known as an ACH payment form, is a document that grants permission to a financial institution to debit or credit an individual or business account. This form is used to authorize the transfer of funds between bank accounts, making it a critical part of electronic transactions.

The ACH Authorization Form plays a significant role in ensuring that transactions are carried out in a secure, efficient, and compliant manner. It provides a record of the agreement between the parties involved in the transaction, detailing the account information, the amount to be transferred, and the frequency of the transactions. This form serves as a safeguard, protecting both the sender and receiver of the funds.

The Process of Granting Permission to Financial Institutions

The process of granting permission to financial institutions through an ACH Authorization Form is straightforward. The party initiating the transaction—either an individual or a business—completes the form, providing all necessary details such as the bank account numbers, the names of the account holders, and the amount to be transferred.

The form also specifies the frequency of the transactions, whether it’s a one-time payment or recurring transactions. Once completed, the form is then submitted to the financial institution carrying out the transaction. The institution uses the information provided in the form to process the transaction accurately and efficiently.

The Role of ACH Authorization Form in Fund Transfer

The ACH Authorization Form plays a crucial role in the fund transfer process. It serves as the basis for the transaction, providing the necessary details for the financial institution to process the payment. Without this form, the institution would not have the authorization to debit or credit the accounts involved.

The ACH Authorization Form is the foundation of the ACH transaction. It ensures that all parties involved in the transaction have agreed to the transfer of funds, providing a level of security and accountability.

At NachaTech, we understand the importance of the ACH Authorization Form in the ACH transaction process. That’s why our ACH file editing and validation tools are designed to work seamlessly with these forms, ensuring that all transactions are carried out accurately and efficiently.

In understanding the standard ACH file format and the role of the ACH Authorization Form, businesses can truly harness the power of electronic transactions, driving efficiency and success in their financial operations.

The Benefits of Using NachaTech for ACH File Editing and Validation

At NachaTech, we understand the complexities and challenges that come with the processing of ACH transactions. The standard ACH file format is not always straightforward, and errors can lead to payment rejections and delays. To help businesses streamline their financial operations and significantly reduce errors, we have designed a powerful tool for ACH file editing and validation.

The Ability to Open and Edit ACH Files with Major Errors

A challenge with ACH file processing is dealing with files that contain major errors. Many of the tools available in the market struggle to open, let alone edit, ACH files with significant errors. This leaves users with the daunting task of trying to fix these errors manually, often leading to further complications.

At NachaTech, we have developed a sophisticated tool that can open and validate ACH files with major errors. Our software provides a user-friendly interface that guides users through the process of editing and rectifying files, even when they contain significant errors. This not only saves time but also ensures that the revised files comply with the NACHA standards.

The Provision of Raw Line Editing

Another standout feature of our software is the provision of raw line editing. This allows for greater flexibility in fixing errors, going beyond the capabilities of regular strong-typed editing. With raw line editing, users can directly edit the raw text of the file. This makes it easy to correct errors efficiently and accurately, ensuring that ACH files align with the NACHA standard.

The Fast Validation of ABA Numbers

Incorrect or invalid ABA numbers are a common cause of ACH file errors. To tackle this issue, our software comes equipped with an embedded ABA database. This enables rapid validation of ABA numbers, allowing users to quickly check the validity of these numbers, eliminating one of the common stumbling blocks in processing ACH transactions.

In conclusion, NachaTech offers a robust solution for businesses looking to streamline their ACH transactions and reduce errors. Our ability to handle ACH files with major errors, coupled with raw line editing and fast ABA number validation, makes us a trusted partner in all your ACH file editing and validation needs. By understanding and effectively utilizing the standard ACH file format, you can significantly reduce the risk of ACH payment rejections and drive efficiency in your financial operations.

Conclusion: The Importance of Understanding Standard ACH File Format

Understanding the standard ACH file format is not just essential, it’s a game-changer in financial transactions. With billions of transactions being performed using the ACH standard, the importance of ACH files cannot be overstated. They form the backbone of countless transactions – from B2B payments to direct deposits.

The ACH file format, with its fixed-width ASCII file, specific record sequence, and standardized codes, is a linchpin for seamless transactions across banks and financial institutions. Its design ensures uniformity, promotes security, and fosters efficiency in monetary exchanges.

Moreover, the NACHA file format, while similar to the ACH file format, offers its own unique features, further enhancing the capabilities of the ACH network. Understanding these formats and their unique elements can significantly reduce the risk of ACH payment rejections and ensure smoother financial operations.

However, mastering the standard ACH file format is not an easy task, especially given the sensitivity of the information they contain. That’s where we, at NachaTech, come into play. Our tools provide the ability to open and edit ACH files with major errors, offer raw line editing, and fast validation of ABA numbers, simplifying the once daunting task of ACH file management.

Embracing the standard ACH file format, understanding its structure, and utilizing the right tools to manage it are crucial steps in ensuring smooth financial transactions. As we move towards an increasingly digital future, businesses that master the ACH file format will be well-positioned to thrive in the evolving landscape of financial transactions.

The key to successful financial transactions lies not just in the transactions themselves, but in the mastery of the tools and systems that facilitate them. That’s why understanding the ACH file format is so crucial. So, here’s to mastering ACH files, eliminating payment rejections, and driving your business towards financial success.

For more information on the intricacies of the ACH file format and how our tools can assist you, please check out our ACH file editing and NACHA file validation sections on our website.