Are you frequently dealing with payment rejections and errors with your NACHA files? To ensure the smooth flow of financial transactions of businesses and financial institutions, understanding the NACHA Rules for Account Validation is crucial. Let us help decode this complex topic for you.

The National Automated Clearing House Association (NACHA) is an organization that sets up rules and standard for ACH transactions, making it an essential part of the modern financial world. These transactions, while efficient, do not process in real-time and exceptions can lead to payment rejections, much like a bounced check. In fact, NACHA’s new enforceable ‘WEB Debit Account Validation Rule’ is aimed at reducing the risk of errors and rejections by clearing up misunderstandings about bank account data validation.

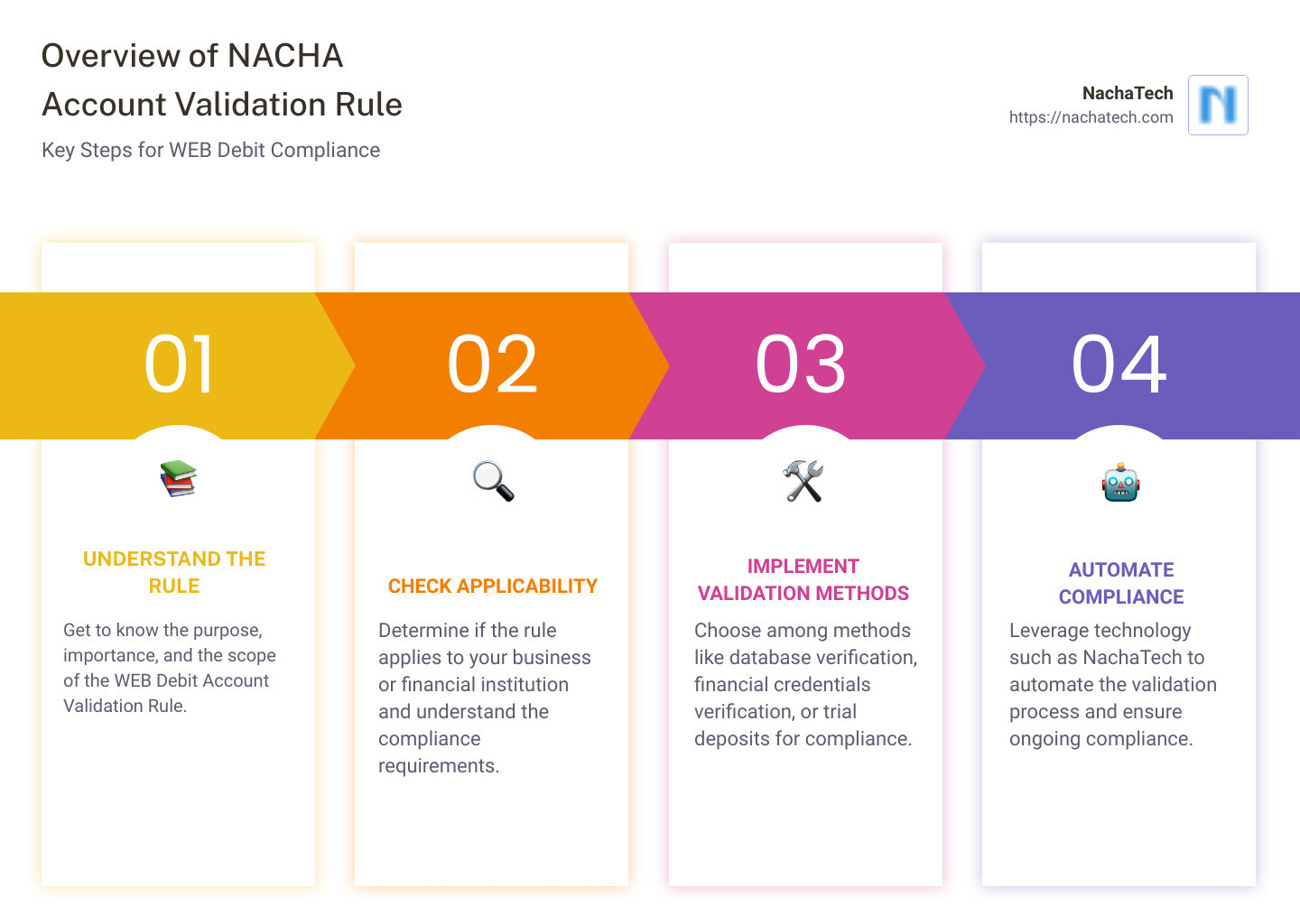

Here’s a quick snapshot of what NACHA’s Account Validation Rule entails:

– Effective from: March 19, 2022.

– Purpose: Validates consumer bank accounts before they are debited for the first time.

– Compliance: Failure to comply can result in penalties and, in worst-case scenarios, account termination.

Understanding this rule and implementing accurate tools for validation, such as those provided by us at NachaTech, will not only reduce your ACH transaction errors but also ensure smoother financial transactions for your institutions.

Understanding the NACHA WEB Debit Account Validation Rule

In the evolving landscape of digital transactions, compliance with regulatory bodies is more important than ever. One of the key players in this sector is NACHA, the regulatory body overseeing Automated Clearing House (ACH) transactions. One of their latest rules that businesses need to be aware of is the WEB Debit Account Validation Rule.

The Purpose and Importance of the Rule

The primary purpose of the NACHA WEB Debit Account Validation Rule is to reduce the risk of fraud in ACH transactions. By ensuring businesses validate customer bank accounts before debiting them, the rule aims to minimize the potential for erroneous or fraudulent transactions.

Account validation helps businesses confirm that the bank account information provided by the customer is correct and that the account is open and active. This not only provides an additional layer of protection to businesses but also enhances the customer’s trust in the company’s transaction process.

Who the Rule Applies To

The NACHA Account Validation Rule applies to all businesses that initiate ACH debit transactions over the internet, also known as WEB transactions. This includes entities such as online retailers, bill payment portals, and subscription-based services.

Whether you’re a small business processing a handful of ACH payments or a large corporation handling thousands of transactions, if you’re initiating ACH debits over the internet, you’re required to validate the bank account information provided by your customers.

The Enforcement Date and Penalties for Non-Compliance

The WEB Debit Account Validation Rule has been in effect since March 19, 2021. However, NACHA has allowed a grace period for businesses working in good faith towards compliance but needing additional time to implement solutions.

Non-compliance with NACHA’s operating rules could result in penalties and, in some cases, account termination. Further, delayed or incorrect validation can lead to transaction errors, rejections, and significant financial losses.

Compliance is not just about avoiding penalties. It’s about creating a secure and efficient transaction environment for your business and your customers. At NachaTech, we offer solutions that assist in fast and accurate bank account validation, allowing your business to seamlessly comply with the NACHA Account Validation Rule.

The Process of Bank Account Validation and Verification

When it comes to ACH transactions, ensuring the accuracy of bank account details is a critical aspect of preventing fraud and ensuring smooth operations. This involves two key processes: validation and verification.

The Difference Between Validation and Verification

Validation is a check of bank account data, such as the account number and sort code, using algorithmic rules. It is essentially a process to determine if an account could potentially exist with the given details. For example, it checks if the number of digits in the account number matches the standard format for that specific bank.

On the other hand, verification is a more in-depth process that checks against actual bank account details. It confirms factors such as account ownership and whether an account is open and active.

While both processes are related, they serve different purposes. Validation ensures that the account details entered are plausible, while verification confirms that they are accurate and tied to a legitimate, active account.

The Importance of Both in Preventing Fraud

Fraudulent ACH transactions can be a significant risk for businesses and financial institutions, potentially leading to substantial financial losses. By validating and verifying bank account details during ACH transactions, you can significantly reduce the risk of fraudulent transactions.

Validation prevents errors at the earliest stage by ensuring that account details are plausible. This can help prevent transactions from being directed to non-existent or incorrect accounts, thereby reducing the risk of transaction errors and rejections.

Verification, on the other hand, adds an extra layer of security by confirming that the account details are not only plausible but also accurate and tied to a legitimate account. This can help identify and prevent potential fraudulent transactions, ensuring that funds are transferred securely and accurately.

At NachaTech, we understand the importance of both validation and verification in preventing fraud. Our software solution provides fast and accurate bank account validation, allowing your business to seamlessly comply with the NACHA rules for account validation and ensure the security of your ACH transactions.

Methods for Complying with the NACHA Account Validation Rule

In order to comply with the NACHA account validation rule, there are several methods that businesses can use. These include database verification, financial institution credentials verification, and trial deposits verification. By implementing one or more of these methods, businesses can ensure that they adhere to the necessary regulations and prevent fraudulent transactions.

Database Verification

Database verification involves checking the account number against a database to ensure its validity. This database can be internal, consisting of account numbers that the business has previously debited, or external, provided by a third-party service. This method is advantageous because it is swift and does not require the customer to take any action. However, it requires the business to have access to accurate and up-to-date databases.

Financial Institution Credentials Verification

This method involves verifying the customer’s bank account credentials. The customer is asked to provide their online banking login details, which are then used to log into the customer’s bank account and verify the account details. This method can provide a high level of assurance, but it requires the customer to trust the business with their sensitive banking information.

Trial Deposits Verification

Trial deposits verification, also known as micro-transaction verification, involves making a small deposit (usually less than $1) into the customer’s bank account. The customer is then asked to confirm the exact amount of the deposit. This method provides a high level of assurance and does not require the customer to share their banking credentials. However, it can take several days to complete, which might not be suitable for businesses that require instant verification.

The Role of Technology in Automating Compliance and Verification

With the advent of technology, compliance with the NACHA account validation rule has become easier and more efficient. Automated solutions such as those provided by NachaTech can help businesses streamline the verification process, reduce the risk of errors, and ensure compliance with NACHA regulations. These solutions can automate the verification process, retrieve additional account details, and even provide real-time validation using up-to-date databases.

By leveraging technology, businesses can not only comply with NACHA rules but also enhance their fraud detection capabilities and increase the volume of their ACH transactions. In today’s fast-paced digital world, staying ahead of regulatory changes and embracing technology is crucial for the seamless operation of any business.

In the next section, we will discuss how NachaTech can help your business comply with the NACHA account validation rule and enhance the security and efficiency of your ACH transactions.

How NachaTech Can Help with NACHA Account Validation

At NachaTech, we understand the complexities of financial transactions and the importance of compliance with NACHA’s account validation rule. That’s why our tool is designed with the specific needs of financial institutions in mind, offering a user-friendly interface, excellent customer support, and a robust set of features to help you validate and verify your ACH transactions efficiently and accurately.

The Unique Selling Point of NachaTech

What truly sets NachaTech apart is our ability to handle ACH files with major errors. Our software allows you to open, edit, and validate these challenging files without resorting to basic text editors like Notepad. This feature alone can dramatically reduce ACH payment rejections, a common problem faced by many financial institutions.

Furthermore, our tool is equipped with an embedded ABA database, which ensures all your ABA numbers are accurate and up-to-date. This database can be updated on-demand from FedACH, allowing you to validate thousands of transactions in mere seconds. For businesses managing large transaction volumes, we also offer a command-line bulk update tool, invaluable for making bulk updates and scrubbing sensitive information.

Our raw line editing feature allows businesses the flexibility to make necessary changes that adhere to NACHA standards. This, combined with our fast ABA numbers validation, significantly reduces the chances of ACH payment rejections.

How NachaTech Can Help Financial Institutions Comply with the Rule

Complying with the NACHA account validation rule doesn’t have to be a daunting task. We stand ready to help your institution navigate this new mandate, providing you with the tools and support you need to ensure compliance and minimize risk.

Our solution can automate the process of compliance, verification, and risk protection, freeing up your time and resources. By implementing our software, you can not only adhere to NACHA’s account validation rule but also boost the security of your ACH transactions, reduce fraud risk, and potentially increase the volume of successful transactions.

NachaTech isn’t just a tool—it’s a comprehensive solution designed to keep your ACH transactions flowing smoothly. By using our software, you can ensure the accuracy and compliance of your ACH files, leading to successful transactions and satisfied customers.

So, let us help you turn the challenge of NACHA’s account validation rule into an opportunity for improved efficiency, security, and customer satisfaction. Trust NachaTech to guide you through ACH file management and ensure your journey is smooth and error-free.

The Impact of the NACHA Account Validation Rule on Businesses and Consumers

The NACHA account validation rule has a significant impact not just on financial institutions and businesses, but also on consumers. From the possibility of increased ACH transaction volume to the potential for lower fraud risk, the implications of this rule are far-reaching.

The Potential Increase in ACH Transaction Volume

With the NACHA account validation rule in place, we at NachaTech foresee a potential increase in ACH transaction volume. As businesses and financial institutions adopt more rigorous account validation methods, it can lead to increased trust and confidence in the ACH network. As a result, businesses could be more inclined to use ACH for transactions, knowing that the risk of errors and rejections is minimized.

This increase in ACH transaction volume can be beneficial for businesses in several ways. It could lead to faster payment processing, improved cash flow, and more efficient business operations. For consumers, an increase in ACH transactions could mean quicker and more reliable payments, enhancing their overall experience and trust in the businesses they deal with.

The Potential for Lower Fraud Risk

The NACHA account validation rule is also designed to lower the risk of fraud in ACH transactions. By requiring businesses to validate first-use consumer account information, the rule aims to ensure that all transactions are legitimate and secure.

This emphasis on security can have a significant impact on fraud risk. With more rigorous validation methods in place, the chances of fraudulent transactions slipping through the cracks are greatly reduced. This not only protects businesses from potential financial losses but also safeguards consumers’ sensitive financial information.

Furthermore, the reduction in fraud risk can also contribute to the potential increase in ACH transaction volume. As the ACH network becomes more secure, businesses and consumers alike can have more confidence in using it for their transactions.

In conclusion, the NACHA account validation rule presents both challenges and opportunities for businesses, financial institutions, and consumers. But with the right tools and approach, such as those provided by NachaTech, it’s possible to turn these challenges into opportunities for improved efficiency, security, and customer satisfaction. This underscores the importance of understanding and complying with the NACHA rules for account validation.

Conclusion: The Future of ACH Transactions and the Importance of Compliance with NACHA Rules

As we look ahead, the future of ACH transactions is promising. The role of ACH and NACHA files in the financial landscape is set to grow, with advancements geared towards increasing efficiency, reducing fraud, and improving transaction speed. The National Automated Clearing House Association (NACHA) is eyeing significant changes to drive the ACH network forward and enhance its reliability and safety.

One such change is the enforcement of the WEB Debit Account Validation Rule. This rule requires businesses to validate consumer bank accounts they haven’t debited before, effectively reducing the risk of fraud and ensuring the integrity of the ACH network. The rule is part of NACHA’s commitment to maintaining the ACH network’s integrity and protecting businesses’ interests.

As financial institutions navigate this evolving landscape, compliance with the NACHA rules for account validation becomes more crucial than ever. Non-compliance could result in penalties and, in some cases, account termination. This underlines the importance of having reliable tools like NachaTech that can help financial institutions comply with the rule and avoid costly consequences.

At NachaTech, we provide advanced editing features for NACHA files, rectify errors and prevent potential rejections, ensuring a smooth transaction process. With our powerful validation and editing features, we are at the forefront of this revolution, providing effective solutions for financial institutions grappling with ACH payment rejections and errors in their NACHA files.

The role of ACH validation tools like NachaTech will become more critical. They are no longer just optional extras; they are essential components for success in the digital financial landscape. By understanding these changes and leveraging tools like NachaTech, businesses can position themselves for success in the evolving landscape of financial transactions.

The future of ACH transactions lies in precision, compliance, and adaptability. This is a future that we at NachaTech are ready to help you navigate. By leveraging advanced software solutions and proactive risk management strategies, you can maintain the integrity of your ACH transactions, enhance operational efficiency, and deliver seamless financial services to your customers.

For more information on how NachaTech can help you comply with NACHA rules for account validation, visit our NachaTech page. For additional resources on the NACHA Account Validation Rule, visit our blog, and for more details about our validation and editing features, check out NachaTech Features.