Are you a financial institution struggling with frequent rejections of Automated Clearing House (ACH) payments? Does making sense of the errors in your NACHA files feel like solving a complex puzzle? This is a widespread pain point in the financial world. Here at NachaTech, we know just how vital it is to ensure smooth and error-free ACH transactions.

This guide aims to demystify the NACHA ACH process, starting from its basic understanding to its seamless operations. NACHA, once known as the National Automated Clearing House Association, is the backbone of the electronic system that connects all U.S. bank accounts. On the other hand, Automated Clearing House (ACH) is an electronic network used for an array of transactions, including direct deposits, bill payments, and business-to-business payments.

As you proceed through this guide, we’ll take you on a comprehensive journey through understanding NACHA’s role in the ACH network and how it facilitates the seamless transfer of funds between different accounts.

Key Facts about NACHA and ACH:

- NACHA was created in 1974 and now operates one of the largest networks that support electronic financial transactions.

- The ACH Network, supervised by NACHA, facilitates billions of financial transactions.

- Embraced by the U.S. financial institutions, NACHA is a non-profit association.

- ACH transactions play a critical role in direct deposits, electronic bill payments, and business-to-business transactions.

Through this guide, our objective is to facilitate efficient processing of transactions, minimize errors and maximize uncomplicated operations. Comfort yourself because you are about to unlock the secret to seamless financial transactions!

The NACHA ACH Process: An Overview

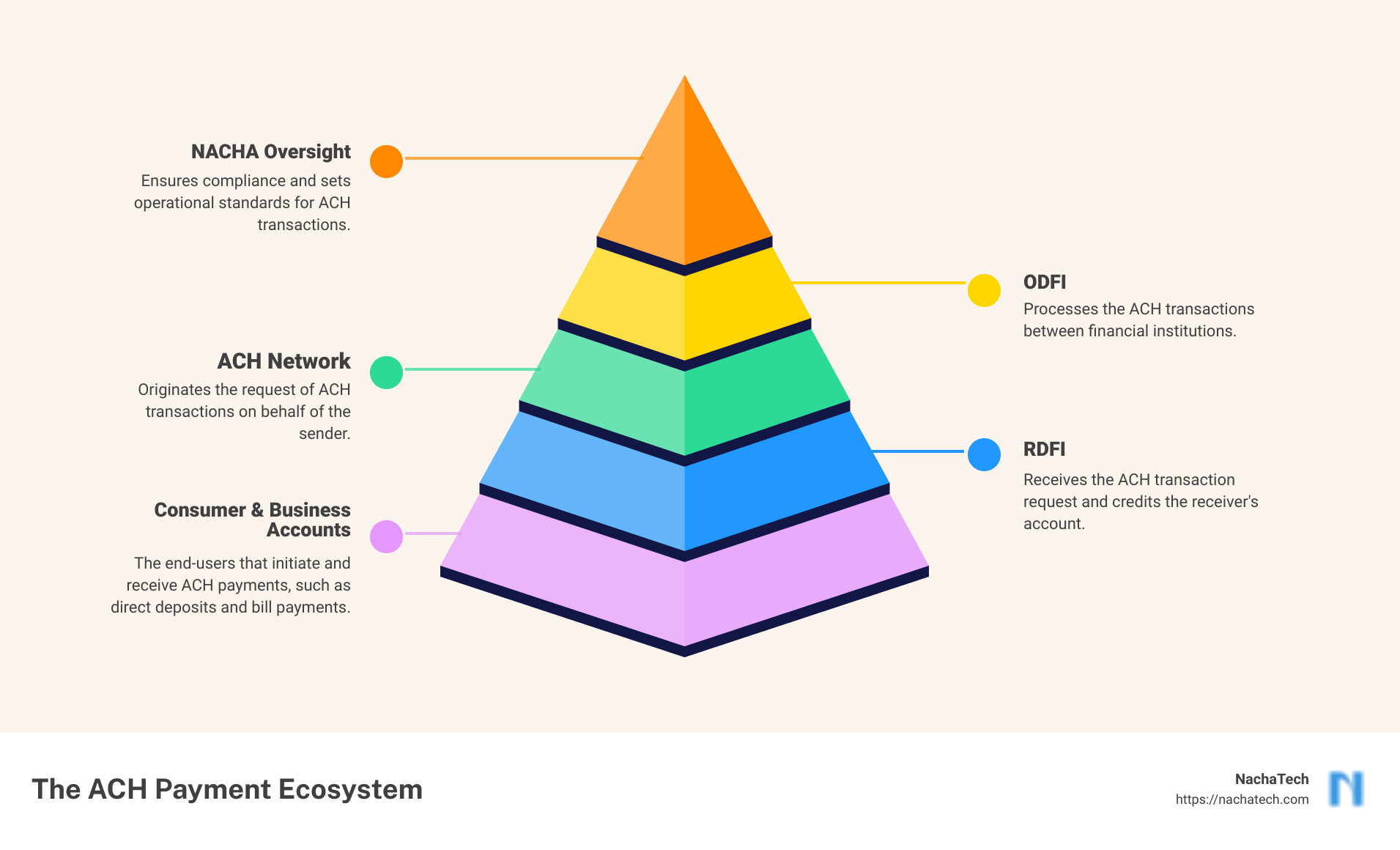

The NACHA ACH process is quite straightforward, yet it involves certain intricacies that require a more in-depth understanding. At the heart of this process, two financial institutions play critical roles: the Originating Depository Financial Institution (ODFI) and the Receiving Depository Financial Institution (RDFI).

The Role of Originating Depository Financial Institution (ODFI) in ACH Process

The ODFI is the banking institution that initiates an ACH transfer request. It’s the bank that sends the request to transfer funds from an account at the RDFI to an account at the ODFI. This means that the ODFI is the institution that your business would interact with when initiating ACH payments.

The Role of Receiving Depository Financial Institution (RDFI) in ACH Process

On the other hand, the RDFI is the banking institution that receives the ACH transfer request from the ODFI. This could be the bank of your employee who’s receiving their paycheck, the bank of your customer who’s making a payment, or simply the bank where you’re transferring funds to another one of your own accounts.

Understanding the ACH Payment Process

To further clarify, let’s consider a practical example of how the ACH payment process works:

- Your business decides to make an ACH payment to an employee, a vendor, or another business.

- You send the payment information to your bank (the ODFI), which includes the recipient’s bank account number, routing number, and the amount to be transferred.

- Your bank then sends the payment request through the ACH network, managed by Nacha.

- The payment request reaches the recipient’s bank (the RDFI).

- The RDFI posts the payment to the recipient’s bank account, completing the transaction.

This process can take a few days, although Same Day ACH services are available, enabling quicker payments and improved cash flow.

At NachaTech, we understand that the ACH process can feel complex, especially when dealing with large volumes of transactions. That’s why we’ve developed a suite of tools to help businesses like yours streamline the ACH process, minimize errors, and ensure compliance with Nacha’s operating rules. Whether you’re just starting with ACH payments or looking to improve your existing processes, our experts are here to guide you every step of the way.

Understanding NACHA ACH Files

Navigating financial transactions can often seem daunting. One key feature that plays a central role in this sphere is the NACHA ACH file. But what exactly is a NACHA ACH file, and why is it important? Let’s delve in.

What is a NACHA ACH File?

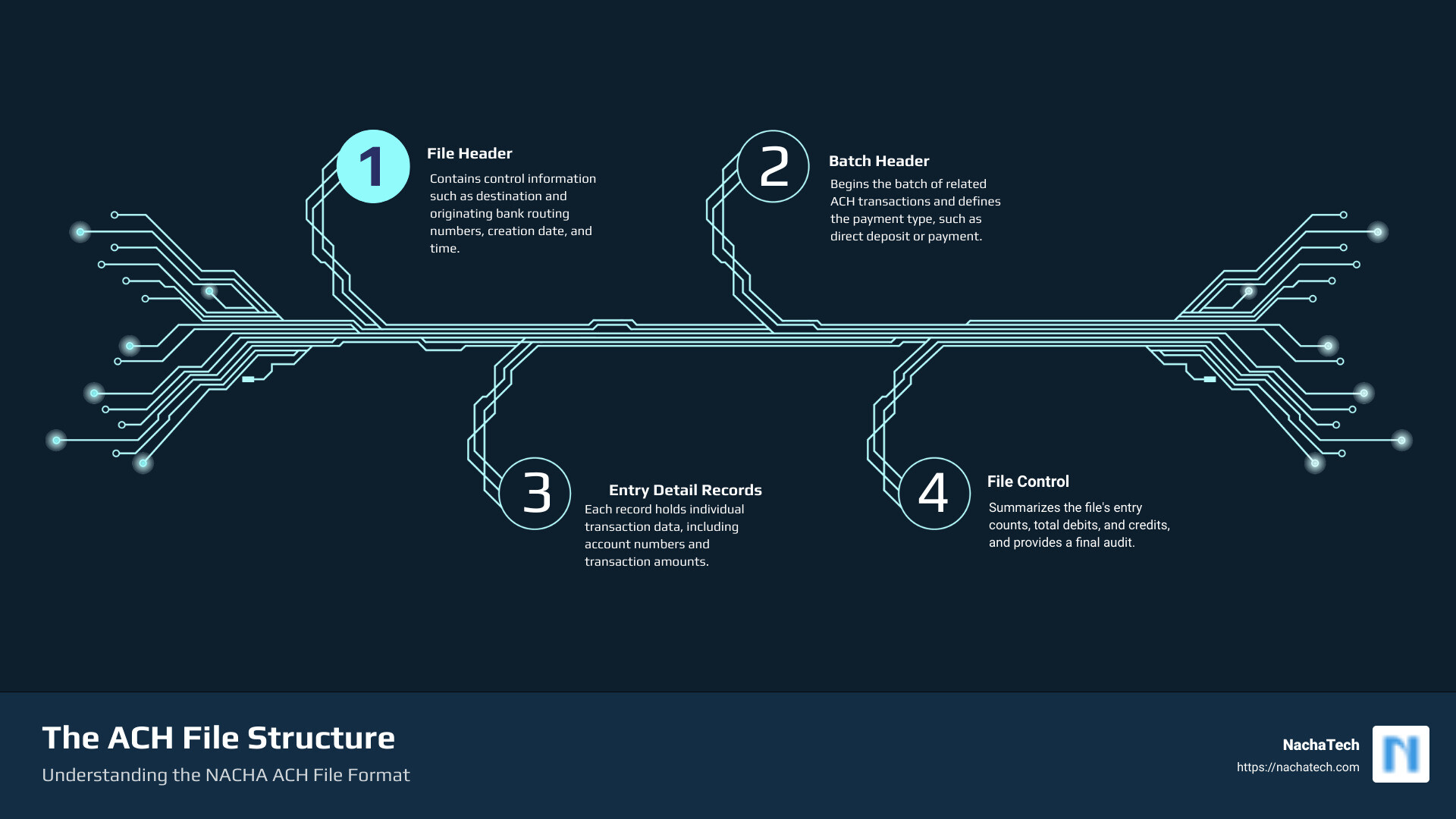

A NACHA ACH file is a specially formatted file used to facilitate Automated Clearing House (ACH) transactions. This file serves as a set of instructions for banks, enabling them to transfer funds between accounts. Each line in this file is 94 characters long and contains specific information such as account numbers for the Originating Depository Financial Institution (ODFI) and Receiving Depository Financial Institution (RDFI), alongside routing numbers and other essential details. The NACHA ACH file must strictly adhere to a specific format to ensure the bank properly executes the transaction.

The Importance of NACHA Files in ACH Payments

The NACHA ACH file is the backbone of ACH payments. They orchestrate the seamless operation of countless transactions, from direct deposits to business-to-business payments. Without NACHA files, these transactions would become a complex, time-consuming process.

However, like any system, NACHA files are not immune to errors. Mistakes can lead to payment rejections, disrupting cash flow, and potentially damaging business relationships. Therefore, understanding the NACHA file format is not a luxury but a necessity in today’s digital age.

How NachaTech Helps in Editing and Validating NACHA Files

This is where we at NachaTech come in. Our software is designed to help businesses navigate the intricate world of ACH transactions. We provide the ability to edit and validate NACHA files with major errors, offering features like raw line editing and fast validation of ABA numbers.

Whether your NACHA file has regular errors or major ones, our software can open and assist in editing them. This is a significant advantage over other tools that fail to open ACH payment files with major errors, forcing users to use notepad to fix these errors without any software assistance.

We aim to make the once daunting task of NACHA file management simpler. Our objective is to help businesses save valuable time and cost by ensuring their ACH files are error-free and do not get rejected.

In conclusion, understanding the NACHA ACH file format is crucial in ensuring smooth financial transactions. With our software at NachaTech, we hope to make this process easier and more efficient for businesses of all sizes.

NACHA Operating Rules and Regulations

As we continue our journey through ACH transactions, we must turn our attention to an important aspect of the process – the NACHA operating rules and regulations. To ensure the integrity and efficiency of the ACH network, Nacha, the organization that oversees the ACH network, has established a set of rules that all participants must follow.

The Importance of Compliance with NACHA’s Rules

Compliance with Nacha’s rules is not just a matter of adhering to guidelines. It’s about ensuring the safety and accuracy of ACH transactions. As the ACH network becomes increasingly prevalent in the financial landscape, the importance of Nacha compliance also escalates.

Non-compliance with these rules can lead to severe penalties, including substantial fines and potential suspension from the ACH network. In extreme cases, these fines can reach up to $500,000 a month. Therefore, it is vital for businesses and third-party senders to stay up to date with Nacha compliance rules.

Key Components of NACHA’s Operating Rules

Nacha’s operating rules encompass a broad range of requirements that businesses must follow if they want to accept ACH payments. Here are some of the key components of these rules

– Communicate clearly to the customer during the payment process that they’re authorizing either a one-time or recurring ACH payment.

– When changing the amount or date of an ACH debit, give adequate notice.

– Ensure that customer payment information is adequately secured.

– Promptly cancel recurring ACH payments and cease future debits when necessary.

These rules are regularly updated and amended, so it’s important to stay informed about any changes.

The Consequences of Non-Compliance with NACHA Rules

Non-compliance with Nacha’s rules can lead to a series of consequences ranging from warnings and fines to suspension from using ACH payments altogether. As we’ve mentioned earlier, some fines can cost as much as $500,000 per month.

Apart from these financial penalties, non-compliance can also lead to disruptions in cash flow, strained business relationships, and damage to your company’s reputation.

At NachaTech, we understand the importance of Nacha compliance. Our software solutions are designed to help you navigate the complexities of ACH transactions while ensuring compliance with Nacha’s rules and regulations.

Successful financial transactions aren’t just about the transactions themselves, but about mastering the tools and systems that facilitate them. And that’s why understanding Nacha’s rules and regulations is so crucial.

The Impact of NACHA ACH on Businesses and Consumers

As we navigate through the intricacies of NACHA ACH, understand its impact on businesses and consumers. The NACHA ACH process offers significant benefits for both parties involved, simplifying transactions and enhancing efficiency.

How ACH Payments Benefit Businesses

ACH payments have emerged as a boon for businesses, particularly in the context of B2B transactions. This can be attributed to their cost-effectiveness and efficiency. ACH transactions are processed in batches, reducing the cost compared to individual transactions. This batch processing approach saves time, a crucial advantage in today’s fast-paced business environment.

Furthermore, ACH payments eliminate the need for paper checks, thereby reducing the chances of human error and streamlining the payment process. Businesses can automate ACH payments, setting up recurring payments for timely transactions without the need for manual intervention.

Moreover, ACH payments are faster than traditional methods like mailing checks. With everything processed electronically, funds move swiftly, enhancing operational efficiency. Utilizing ACH for B2B payments can lead to significant cost savings, improved payment speed, and reduced error rates.

How Consumers Benefit from ACH Payments

Consumers also stand to benefit significantly from ACH payments. For instance, Direct Deposit, a well-known feature of ACH, allows for the safe and secure transfer of wages, tax refunds, government benefits and more directly into a bank account. This eliminates the need to cash checks, and the funds are available immediately.

Moreover, ACH payments can also be used for a variety of transactions such as paying bills, making charitable donations, paying college tuition, or sending funds between family and friends, providing consumers with a versatile and efficient payment method.

The Role of Third-Party Payment Processors in ACH Payments

Third-party payment processors play a significant role in ensuring the smooth operation of ACH payments. For example, if a business is using a third-party payment processor like GoCardless to handle ACH payments, Nacha compliance is already taken care of.

These processors handle the compliance and processing aspects, allowing businesses to focus on their core operations. They ensure that the transactions are processed correctly and in accordance with the NACHA operating rules, thus reducing the risk of payment rejections and errors.

Understanding the NACHA ACH process and its impact can help businesses and consumers make the most of this efficient and secure system of electronic payments. At NachaTech, we are committed to helping financial institutions navigate this process with our state-of-the-art tools and software solutions.

Future Developments in NACHA ACH: What to Expect in 2023

As we continuously adapt to the digital transformation, so does the role of ACH and NACHA files in financial transactions. The National Automated Clearing House Association (NACHA) is always on the lookout for significant changes that can enhance the reliability, safety, and efficiency of the ACH network. Let’s delve into what you can expect in the coming years.

The New Rules for ACH in 2023

As part of NACHA’s commitment to maintaining the integrity of the ACH network and protecting the interests of businesses, new rules are continuously being developed and implemented. For instance, rigorous account validation as part of a “commercially reasonable fraudulent transaction detection system” for screening WEB debits was enforced in 2021.

As businesses and consumers, staying updated with NACHA’s evolving rules and guidelines is crucial. This ensures seamless transactions and helps avoid possible breaches that could lead to severe fines or suspension from the platform.

The Impact of the Increased Per-Transaction Limit for Same-Day ACH

One of the promising changes in the ACH network is the extension of the Same Day ACH window. This provides two additional hours for transactions, a particular advantage for west coast financial institutions.

Same Day ACH is a game-changer as it allows for the processing of ACH transactions on the same day, ensuring quicker payments and improved cash flow. However, not all transactions qualify for Same Day ACH, and certain conditions need to be met.

How Businesses and Consumers Can Prepare for the Changes

As we look forward to these developments, prepare for the changes that lie ahead. For businesses, staying abreast of NACHA’s evolving rules and regulations is a must. Regularly visiting the NACHA website for updates or utilizing tools like NachaTech can help in this regard.

For consumers, being aware of changes, such as the extension of the Same Day ACH window, can help plan and manage their transactions better.

At NachaTech, we are committed to helping both businesses and consumers navigate these changes efficiently. Our software solutions are designed to manage ACH files effectively, reducing errors, and ensuring timely and secure transactions.

As the ACH network continues to play a critical role in the payment landscape, understanding the nacha ach process and staying updated with its changes is more important than ever.

Conclusion: The Importance of Understanding the NACHA ACH Process

In the intricate world of financial transactions, understanding the NACHA ACH process is not just a luxury but a necessity. As we’ve discussed in this guide, NACHA (National Automated Clearing House Association) plays a crucial role in the administration, development, and governance of the ACH network, the electronic system facilitating the movement of money in the United States.

But why does this matter to your financial institution? Simply put, mastering the NACHA ACH process can be a game-changer. As we move towards an increasingly digital future, businesses that understand the ACH process, its rules, and the NACHA file format will be well-positioned to thrive in the evolving landscape of financial transactions.

Furthermore, understanding the NACHA ACH process can help reduce payment rejections and errors in NACHA files. This is more critical than ever as errors and inaccuracies can disrupt cash flow and strain business relationships. At NachaTech, we understand this challenge and provide solutions that simplify the once daunting task of ACH file management. By offering features like raw line editing and fast validation of ABA numbers, we help financial institutions ensure smooth, secure, and error-free transactions.

Moreover, as the ACH network continues to play a critical role in the payment landscape, staying updated with NACHA’s rules and guidelines is essential. The regulations are continually evolving, and failure to comply can result in severe consequences, including hefty fines and suspension from the platform. Hence, it becomes imperative for businesses to stay abreast of NACHA compliance rules and regulations.

Lastly, the ACH network’s role is only expected to grow in the future. The importance of NACHA compliance will likely increase, and the guidelines themselves will need to be constantly updated to stay relevant for new developments in payment processing. By understanding the NACHA ACH process, your financial institution can better adapt to these changes and leverage them for success.

In conclusion, understanding the NACHA ACH process is crucial for financial success. It’s the key to successful financial transactions, not just in the transactions themselves, but in the mastery of the tools and systems that facilitate them. So, here’s to mastering the ACH process, eliminating payment rejections, and driving your business towards financial success.