Quick Answer: ACH Manager is a tool that helps financial institutions and businesses streamline and manage Automated Clearing House (ACH) payments efficiently. It reduces errors, automates processes, and ensures faster, more secure transactions.

- Simplify and automate ACH transaction processing.

- Quickly correct and validate NACHA file errors.

- Enhance security and compliance in transactions.

- Improve operational efficiency and cash flow.

Automated Clearing House (ACH) transactions form the backbone of the modern financial ecosystem, enabling businesses and individuals to transfer funds electronically with ease and security. The importance of ACH cannot be overstated; it underpins everything from direct deposit paychecks to automated bill payments, offering a level of convenience and reliability that traditional paper checks simply cannot match.

However, managing ACH transactions, particularly for financial institutions, comes with its own challenges. Processing errors, compliance with rapidly evolving regulations, and maintaining efficient operations can become significant hurdles. This is where an ACH Manager steps in, providing the tools and capabilities to manage these processes smoothly.

For financial institutions grappling with ACH payment rejections and seeking to improve their NACHA file handling, understanding the essentials of ACH management is pivotal. This introduction aims to lay the groundwork for recognizing the critical role of ACH transactions in banking today and how effective management of these transactions can transform your operations.

Understanding ACH and Its Importance in Banking

When we dive into banking and finance, certain terms and processes are pivotal to its operation. Among these, the Automated Clearing House (ACH) and Electronic Funds Transfer (EFT) stand out as essential components. Their management, particularly through tools like ACH Manager, plays a crucial role in the smooth functioning of financial transactions.

Automated Clearing House (ACH) is akin to the financial world’s highway system. It’s an electronic network that facilitates the movement of money and information between banks and financial institutions. Imagine you’re sending money to a friend or a business is paying its employees; ACH is what often makes this possible without the need for physical checks.

Electronic Funds Transfer (EFT) is the vehicle that travels on this highway. It represents the actual movement of money from one account to another, electronically. This could be your direct deposit salary, a bill payment, or a transfer to a friend. EFTs utilize the ACH network to ensure these transactions are completed efficiently and securely.

At the heart of this system is Nacha, originally the National Automated Clearinghouse Association. Think of Nacha as the traffic controller for the ACH network. It sets the rules, standards, and procedures that ensure the ACH system operates smoothly, securely, and reliably. Nacha’s governance ensures that billions of transactions annually, involving trillions of dollars, are executed without a hitch.

The importance of ACH in banking cannot be overstated. It underpins the vast majority of electronic money movements in the United States. From payroll to tax payments, from consumer bill payments to business-to-business transactions, ACH is fundamental. Its efficiency, security, and cost-effectiveness make it an indispensable part of the financial landscape.

ACH Manager emerges as a powerful tool in this context. It acts as a control center for businesses, allowing them to manage their payables and receivables efficiently. By providing a seamless interface through online banking platforms, ACH Manager enables businesses to process transactions quickly, reduce errors, and improve cash flow. This is not just about moving money; it’s about enhancing operational efficiency and financial oversight.

In summary, understanding the Automated Clearing House, Electronic Funds Transfer, and the role of Nacha is essential for anyone involved in banking and finance. These components form the backbone of the financial industry’s transactional capabilities. Effective management of these processes, through tools like ACH Manager, is not just beneficial; it’s crucial for business success and financial health. The role of ACH and its management will only grow, underscoring the importance of staying informed and leveraging the right tools for financial transactions.

In the next section, we will explore the key features of an effective ACH Manager and how it can transform business operations, highlighting the importance of automation, cash flow control, efficiency, and security in today’s digital age.

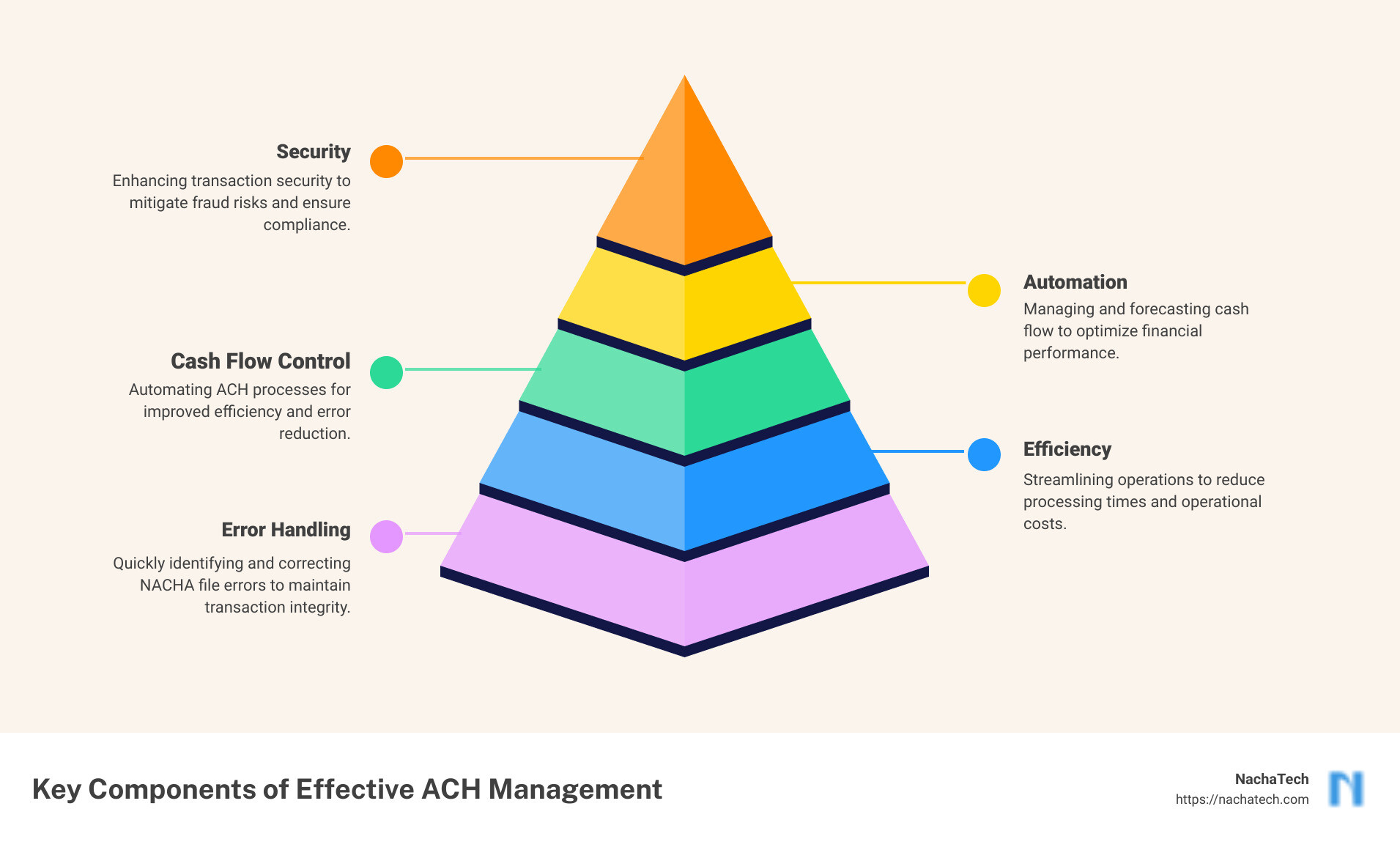

Key Features of an Effective ACH Manager

In the realm of financial transactions, the role of an ACH Manager cannot be overstated. It’s akin to having a Swiss Army knife in banking and finance; it’s versatile, efficient, and indispensable for businesses. Let’s dive into the key features that make an ACH Manager not just a tool, but a transformative force for your operations.

Automation: The Heartbeat of Efficiency

Imagine a world where you could eliminate manual processes, reduce errors, and save time with just a few clicks. That’s the world an effective ACH Manager offers through automation. It’s like setting a well-oiled machine into motion, where payments, including direct deposits and invoices, are processed without the need for constant human intervention. This not only speeds up transactions but also allows your team to focus on tasks that require a human touch.

Cash Flow Control: The Financial Lifeline

Cash flow is the lifeline of any business. An effective ACH Manager gives you the reins to control and predict your cash flow with precision. It’s like having a crystal ball that helps you foresee and manage the funds flowing in and out of your business. This level of control is crucial for making informed decisions, ensuring you have enough cash on hand to cover expenses, and identifying potential cash flow challenges before they become problems.

Efficiency: Doing More with Less

In today’s world, efficiency isn’t just nice to have; it’s a necessity. An effective ACH Manager streamlines operations, making processes leaner and more agile. It’s about doing more with less—less time, less effort, and fewer resources. By reducing the reliance on paper checks and manual processing, businesses can cut costs and improve their bottom line. It’s akin to trimming the fat off your operations, leaving a lean, mean, financial machine.

Security: The Guardian of Your Transactions

Security is paramount. An effective ACH Manager acts as a guardian for your transactions, employing robust security measures to protect against fraud and unauthorized access. Think of it as a fortress, safeguarding your financial data and ensuring that every transaction is secure. With features like encryption and multi-factor authentication, you can have peace of mind knowing that your business’s and customers’ information is protected.

In conclusion, an effective ACH Manager is more than just a tool; it’s a strategic asset that can transform your business operations. By leveraging automation, you can streamline processes and free up valuable time. With cash flow control, you can manage your finances more effectively. Efficiency allows you to do more with less, cutting costs and improving profitability. And with strong security measures in place, you can protect your business from the ever-present threat of cybercrime. We’ll delve into how these features can specifically transform business operations, underscoring the importance of choosing the right ACH management solution.

How ACH Manager Transforms Business Operations

In today’s business environment, efficiency, and cost reduction are more than just goals—they’re necessities. This is where an ACH manager plays a pivotal role, transforming the way businesses handle financial transactions in several key areas.

Direct Deposit

Imagine a world where payroll is as simple as clicking a button. That’s the reality with ACH manager. By enabling direct deposit, businesses can eliminate the need for paper checks, ensuring that employees receive their earnings quickly and securely. This not only saves time but also enhances employee satisfaction.

Invoice Payments

Paying invoices is another area where ACH manager shines. Traditional methods involve writing checks, mailing them, and then waiting for them to be cashed—a process that can take days, if not weeks. With ACH manager, businesses can pay their invoices electronically, streamlining the process and improving cash flow management. This means less time spent on manual tasks and more time focusing on what matters most—growing your business.

Fund Transfers

Transferring funds between accounts, especially across different financial institutions, can be cumbersome. ACH manager simplifies this process, allowing for seamless fund transfers. Whether it’s moving money between company accounts or paying vendors, transactions are smoother and faster, helping businesses operate more efficiently.

Reduce Check Costs

The cost of using checks adds up—printing, postage, and processing fees can take a significant bite out of a company’s budget. By leveraging ACH manager for transactions, businesses can drastically reduce these costs. Furthermore, by minimizing the reliance on paper checks, companies also reduce their environmental footprint, aligning with modern sustainability goals.

By integrating ACH manager into their operations, businesses can enjoy a host of benefits that directly impact their bottom line. From ensuring employees are paid on time with direct deposit to streamlining invoice payments and fund transfers, the efficiencies gained are undeniable. Moreover, the significant reduction in check-related costs not only saves money but also supports a greener, more sustainable approach to business operations. As we explore further, it becomes clear that selecting the right ACH management solution is crucial for harnessing these benefits effectively.

Choosing the Right ACH Management Solution

When it comes to managing electronic payments, choosing the right ACH management solution is like picking the perfect tool for a job. It’s not just about getting the job done; it’s about doing it efficiently, securely, and in a way that fits your unique business needs. Let’s dive into the key aspects to consider: flexibility, user-friendly interface, security features, and integration capabilities.

Flexibility

Flexibility is the backbone of a good ACH manager. Imagine you’re a chef in a kitchen. Some days you might be cooking for a small group, on others for a large banquet. Similarly, your business’s payment needs can vary. One day you might be processing a handful of transactions, and the next, thousands. A flexible ACH management solution scales with your business, adapting to your changing needs without skipping a beat.

User-friendly Interface

Next, consider the user-friendly interface. Here’s the thing: You shouldn’t need a Ph.D. in computer science to manage your payments. The best ACH managers are like a friendly guide in a foreign city – they make navigation effortless, even enjoyable. Look for solutions that offer clear, intuitive layouts. This ensures that you, or anyone in your team, can manage transactions smoothly without unnecessary headaches or calls to support.

Security Features

Security is non-negotiable. Think of it as locking your doors at night; it’s a basic step that keeps the bad guys out. A robust ACH management solution should come fortified with state-of-the-art security features. Encryption, multi-factor authentication, and compliance with financial regulations are just the start. These features protect your business and your customers from the ever-present threat of cybercrime.

Integration Capabilities

Lastly, integration capabilities. In our interconnected world, your ACH manager shouldn’t be an island. It should seamlessly integrate with your existing accounting software, CRM, and other business tools. This connectivity is like a team of relay racers passing the baton flawlessly; it ensures data flows smoothly across your systems, minimizing manual entry and the errors that come with it.

In conclusion, selecting the right ACH management solution is about finding a balance. It’s about choosing a system that’s as flexible as it is user-friendly, as secure as it is integrable. With these factors in mind, you’re well on your way to streamlining your business operations, safeguarding your transactions, and setting your business up for success. Next, we’ll tackle some common challenges in ACH management and how to overcome them.

Common ACH Management Challenges and Solutions

Managing ACH transactions might seem straightforward, but several hurdles can pop up along the way. Let’s dive into some common issues and how you can smoothly navigate them.

Error Handling

Errors in ACH transactions can be a real headache. They can range from incorrect account numbers to mismatched amounts. NachaTech offers a robust solution with its advanced editing features for ACH files. It allows you to open and edit ACH files, catching major errors before they cause rejections or delays. Think of it as having a safety net, ensuring your transactions are accurate and compliant.

Compliance

Staying compliant with ACH regulations is crucial. The rules are there to protect both businesses and consumers. However, keeping up with updates can be challenging. The good news? Solutions like ACH Manager are designed with compliance in mind. They are updated to reflect the latest regulatory requirements, taking a load off your shoulders. Staying compliant isn’t just about avoiding fines; it’s about maintaining trust in your payment processes.

Transaction Speed

In today’s world, speed matters. Traditional ACH transactions can take a few days to process, which might not always cut it. Enter Same Day ACH—an option that speeds things up. While not all transactions are eligible, incorporating Same Day ACH through an efficient ACH Manager can significantly reduce wait times, enhancing your operational efficiency.

NachaTech

When faced with challenges like error handling, compliance, and transaction speed, NachaTech emerges as a reliable ally. It’s not just a tool; it’s a comprehensive solution that addresses the core needs of ACH transaction processing. With features like fast validation of ABA numbers and raw line editing, it streamlines the ACH management process, ensuring your transactions are not only quick but also secure and compliant.

Managing ACH transactions doesn’t have to be a daunting task. By leveraging the right tools and staying informed, you can overcome common challenges with ease. Whether it’s through error correction, compliance adherence, or speeding up transactions, solutions like ACH Manager and NachaTech are here to guide you through the complex landscape of ACH payments. Keep these strategies in mind to enhance your ACH management practices and drive your business towards greater efficiency and reliability.

Next, we’ll explore some of the most frequently asked questions about ACH management to further demystify this essential financial tool.

Frequently Asked Questions about ACH Management

Navigating Automated Clearing House (ACH) payments can seem complex. But don’t worry, we’re here to make it simple. Let’s dive into some common questions about ACH management.

What is an ACH manager?

An ACH manager is a tool or service that helps businesses and individuals manage their ACH transactions. Think of it as a digital assistant that handles the sending and receiving of electronic payments. With an ACH manager, you can pay your employees, send invoices, and transfer funds between accounts—all without touching a single check. It’s about making your financial transactions smoother, faster, and cheaper.

How does ACH payment processing work?

Imagine you’re at a dance, but instead of people, you have banks and transactions moving to the beat. Here’s the simple breakdown:

- Authorization: First, the person or business wanting to make a payment gets permission from the other party’s bank account.

- Initiation: They then submit a digital request, kind of like sending a letter, but this one goes to their bank or a third-party processor.

- Processing: This digital letter, known as an ACH file, travels to a central system that sorts these letters and sends them to the right banks.

- Settlement: The receiving bank gets the message and either adds or takes money from the account, depending on the transaction.

- Notification: Finally, the recipient gets a note saying, “Hey, you’ve got money!”

It’s a bit like sending an email, but for bank transactions. And it usually takes about 1-2 business days to complete.

Who manages the ACH network?

The ACH network is like a big dance floor for banks, and it’s managed by an organization called Nacha. Nacha sets the rules for the dance, making sure everyone moves smoothly and safely. They’re the ones who make sure your money gets where it’s going, securely and efficiently. They also work on making the ACH network better, like introducing same-day transactions for those who need their payments to move faster.

By understanding these basics, you’re well on your way to mastering ACH management. Whether you’re paying employees or managing invoices, an ACH manager can simplify your financial operations, giving you more time to focus on growing your business.

Remember that choosing the right ACH management solution is crucial for ensuring your transactions are not just efficient but also secure.

Conclusion

In wrapping up, the journey through understanding and utilizing ACH management has shown us how pivotal it is in the modern financial landscape. The essence of ACH management, especially through tools like an ACH manager, boils down to making your business transactions smoother, faster, and more reliable.

Benefits of ACH Management

Let’s quickly recap the key benefits that ACH management brings to the table:

- Cost Efficiency: ACH transactions often cost less than traditional methods like checks or credit card payments. This can translate into significant savings, especially for businesses with a high volume of transactions.

- Time-Saving: By automating processes such as payroll and vendor payments, businesses can save on the hours typically spent on manual processing.

- Improved Cash Flow: Faster processing times mean quicker access to funds, improving overall cash flow management.

- Reduced Errors: Automation minimizes the risk of human error, ensuring more accurate transactions.

- Enhanced Security: ACH transactions are governed by strict regulations, offering a secure way to transfer funds.

NachaTech as a Solution

When we talk about navigating the challenges and harnessing the full potential of ACH transactions, NachaTech emerges as a beacon of innovation and reliability. With its robust features designed to tackle ACH payment rejections and streamline the validation process, NachaTech stands out as an indispensable tool for businesses aiming to optimize their ACH operations.

- Error Handling: NachaTech’s ability to open and edit ACH files with major errors simplifies the correction process, turning potential headaches into minor hiccups.

- Fast Validation: The platform’s rapid validation of ACH files, including ABA numbers, ensures that your transactions are not just speedy but also secure.

- Comprehensive Support: From addressing common reasons for ACH payment rejections to providing a suite of tools for efficient transaction processing, NachaTech offers a holistic approach to ACH management.

NachaTech equips businesses with the tools they need to navigate the complexities of ACH payments, ensuring that transactions are not just efficient but also aligned with the latest compliance standards.

As we close this guide, it’s clear that the right ACH management solution, especially one powered by the capabilities of NachaTech, can transform how businesses handle their financial transactions. It’s not just about moving money; it’s about moving forward with confidence, knowing that your ACH processes are in good hands.

Whether you’re just starting to explore ACH transactions or looking to refine your existing processes, the goal is to make financial operations a seamless part of your business growth. With the insights and tools discussed, you’re well on your way to achieving just that.