Quick Guide to ABA Number Validation:

– Understand the Need: ABA numbers are essential for identifying the financial institution in a transaction.

– Purpose: They ensure that money moves accurately and swiftly between accounts.

– Validation is Key: Validating ABA numbers prevents transaction errors and potential fraud.

In financial transactions, getting things right the first time is not just a convenience—it’s a necessity. One key player in this process is the ABA (American Bankers Association) number, also known as the routing number. These nine-digit codes are the unsung heroes of the banking world, guiding payments and transfers to their intended destinations with precision. However, just knowing an ABA number isn’t enough; validating it is critical to ensuring the smooth processing of transactions, whether you’re handling direct deposits, ACH payments, or wire transfers.

For financial institutions grappling with ACH payment rejections and inaccuracies in NACHA files, the stakes are high. Incorrect ABA numbers can lead to delayed transactions, frustrated customers, and increased operational costs. That’s where ABA number validation tools like NachaTech come into play. These solutions provide a fast, reliable way to check that routing numbers are correct and match the intended financial institution, reducing the risk of errors and boosting transaction efficiency.

In the world of finance, taking the time to validate ABA numbers can save much more than just time—it can safeguard your reputation and ensure trust in your transactions. Let’s dive deeper into why ABA numbers hold the key to secure and efficient financial transactions.

Understanding ABA Numbers

When we talk about ABA numbers, we’re diving into the backbone of the American banking system. These numbers are like the DNA for banks, unique identifiers that ensure money moves smoothly and accurately from one place to another. Let’s break it down into simpler terms.

Routing Number

Think of a routing number as the address for a bank. Just like you need an address to send a letter to a friend, you need a routing number to send money to a specific bank. It’s a nine-digit code that tells the financial system where to channel funds during a transaction.

Financial Institutions

Every financial institution in the U.S. that handles transactions has an ABA number. This includes big banks, credit unions, and savings and loans associations. These institutions rely on ABA numbers for a variety of transactions, from setting up direct deposits to processing checks.

ACH

ACH stands for Automated Clearing House, a network used for electronic payments and money transfers. ACH is like the digital highway for transactions such as your paycheck being deposited into your account or your monthly rent payment. The ABA number ensures your money gets to the right bank through this network.

Fedwire

On the other hand, Fedwire is a system used for real-time gross settlement of high-value or urgent transfers, like a large business transaction or a down payment on a house. These transactions are processed one at a time, and, again, the ABA number acts as the guide, making sure the funds reach the correct destination promptly.

Why is this important? Without the correct ABA number, transactions could get sent to the wrong place, causing delays or even financial losses. For businesses, this could mean payroll mishaps or delayed payments to vendors. For individuals, it could mean late bills or missing funds.

In a nutshell, ABA numbers are essential for ensuring that every transaction reaches its intended destination without any hiccups. Whether it’s a paycheck, a bill payment, or a large wire transfer, these numbers guide the financial system, keeping our money flowing correctly.

Remember that the ABA number validation tool is your best friend in confirming that you have the right routing number. This tool not only helps in preventing errors but also plays a crucial role in fraud prevention. With the rise of digital transactions, ensuring the authenticity of ABA numbers has never been more critical.

In the next section, we’ll explore the tools and resources available for ABA number validation, including how NachaTech stands out in ensuring the accuracy and security of financial transactions. Stay tuned to learn how you can leverage these tools for peace of mind in your banking activities.

How to Verify an ABA Number

When it comes to financial transactions, making sure you have the correct ABA routing number is like ensuring you have the right address before sending a letter. If you get it wrong, your money might not reach its intended destination. Here’s how to verify an ABA number, using various tools and resources:

Routing Number Lookup

A straightforward way to verify an ABA number is through a routing number lookup tool. These tools are designed to match the routing number you have with the bank it’s associated with. Trustpair and the Federal Reserve’s own lookup tool are good places to start. They’re like the GPS for banking, guiding your transactions to the right bank.

ABA’s Website

The American Bankers Association (ABA) website is another reliable resource. It offers a lookup service where you can enter the routing number and find out which bank it belongs to. However, there’s a limit on how many lookups you can do per day or month. It’s like having a limited number of tries to guess the correct answer in a quiz.

Bank’s Website

Most banks list their ABA routing numbers on their websites. Usually, you can find it in the FAQs section, at the bottom of the homepage, or within your online banking portal. It’s like finding a recipe on your favorite cooking website; it’s there, you just need to know where to look.

Google Search

While a Google search can yield the routing number for many banks, caution is advised. Banks may use different routing numbers for different regions or types of transactions. It’s akin to searching for a phone number online; you might find the right one, but double-checking is always a good idea.

Remember, using an ABA number validation tool is not just about ensuring that your money goes where it’s supposed to. It’s also about security. An incorrect routing number can delay transactions or, worse, expose you to fraud.

In financial transactions, being equipped with the right tools and knowledge to verify an ABA routing number is crucial. Whether you’re setting up a direct deposit, paying bills, or transferring funds, taking a moment to verify can save you time and hassle. And with tools like NachaTech, you’re not only ensuring that your transactions are accurate but also secure.

Let’s delve into the specifics of the tools and resources available for ABA number validation and how they can help secure your transactions against errors and fraud.

Tools and Resources for ABA Number Validation

Validating an ABA number is crucial for ensuring that financial transactions are processed smoothly and securely. Thankfully, there are several tools and resources at your disposal to help with this task. Let’s explore some of the most reliable options.

Routing Number Lookup Tool

One of the simplest ways to validate an ABA number is by using a Routing Number Lookup Tool. These tools are designed to provide instant verification of routing numbers. You just need to enter the routing number in question, and the tool does the rest, cross-referencing it against a comprehensive database of ABA numbers. Websites like RoutingTool™ offer such services, boasting databases that include every routing number in the U.S. banking system.

Federal Reserve Database

The Federal Reserve’s official website hosts a public database where you can search for routing numbers. This is a trusted source, given that the Federal Reserve plays a central role in the U.S. payment system. Their database, available at fededirectory.frb.org, is regularly updated, ensuring you have access to the most current information.

Online Banking Portals

Most banks provide their routing numbers on their websites. This can be particularly useful if you’re looking to validate the ABA number of a specific bank. Typically, this information is found in the FAQs or the “Help” section of the bank’s website. It’s a straightforward way to get the information directly from the source.

NachaTech

NachaTech stands out by offering advanced ABA number validation tools like iBankRegistry™ Routing Number Verification. This tool validates RTN numbers for both U.S. and Canadian financial institutions in real-time, ensuring that your financial institution always uses accurate and up-to-date routing numbers. It’s a robust solution for those looking to minimize errors and transaction failures.

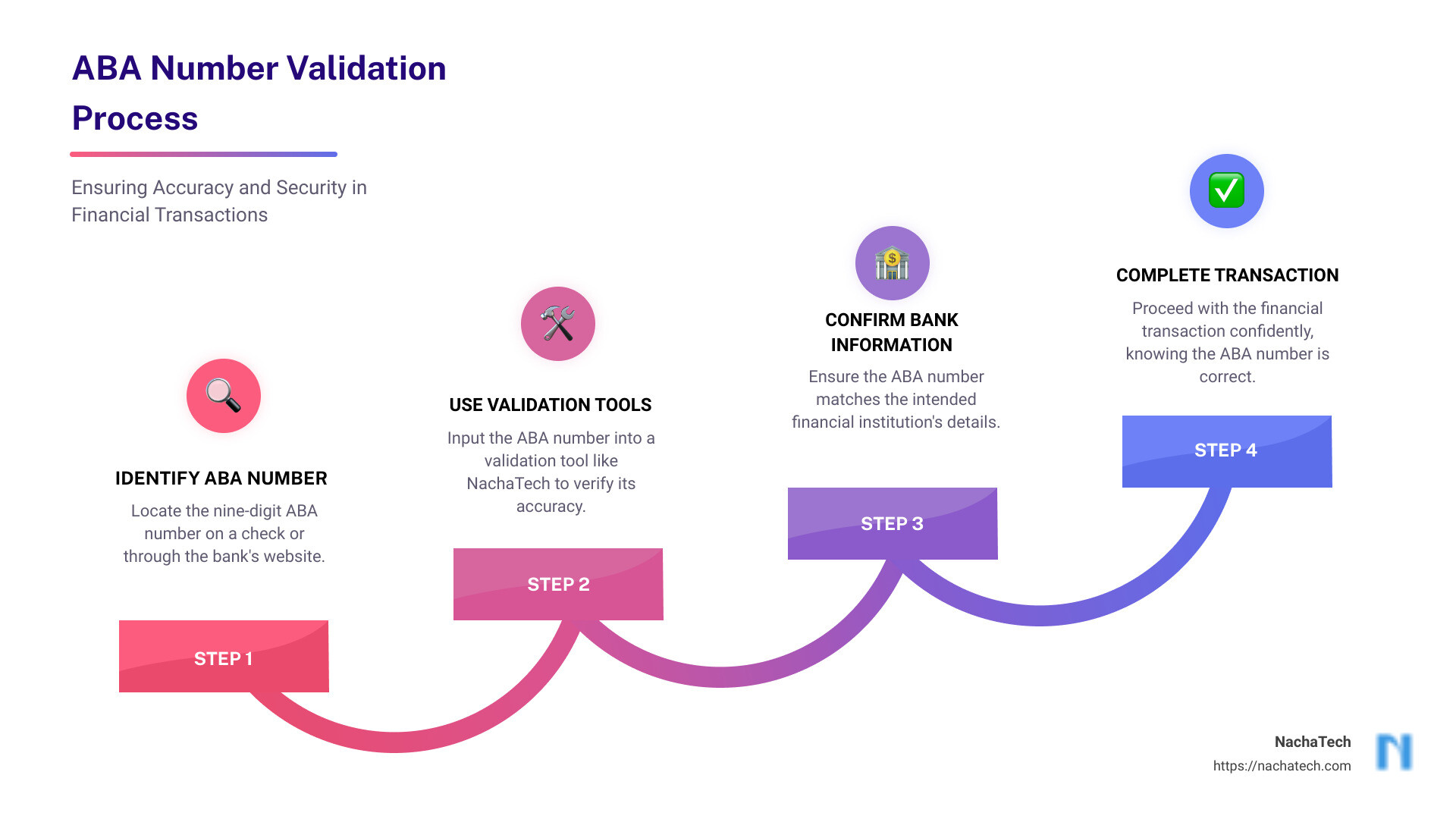

How to Use These Tools Effectively

- Identify the Need: Determine whether you’re validating a routing number for a one-time transaction or if you need a tool for ongoing verification processes.

- Choose the Right Tool: For one-off verifications, the Federal Reserve Database or your bank’s online portal might suffice. For more frequent needs, consider a dedicated tool like RoutingTool™ or NachaTech’s offerings.

- Verify the Information: Once you’ve selected your tool, enter the routing number to verify its authenticity. If you’re using a bank’s website, you might also find additional information helpful for your transaction, such as the bank’s address and contact details.

- Record the Results: Keep a record of the verification for your files, especially if the transaction is significant. This could be useful in the event of any disputes or issues down the line.

In conclusion, whether you’re processing a one-time wire transfer or managing regular direct deposits, using the right ABA number validation tool can save you from potential headaches caused by incorrect routing numbers. Tools like the Federal Reserve Database, online banking portals, and specialized services from companies like NachaTech ensure that you have access to accurate information, keeping your transactions secure and compliant. As we move on to addressing common questions about ABA number validation, choosing the right tool is key to ensuring the security and efficiency of your financial transactions.

Common Questions on ABA Number Validation

Navigating ABA numbers can be tricky, but it’s crucial for ensuring your financial transactions go smoothly. Let’s break down some common questions to make this easier to understand.

How do I find my bank’s routing number?

Check the bottom of your check: The simplest way to find your bank’s routing number is to grab your checkbook. Look at the bottom left corner of your check. The first nine-digit code is your ABA routing number.

Bank’s website: Most banks list their routing number on their official website. Usually, it’s found in the footer of the website or within the FAQs or help section.

Online banking: If you use online banking, logging into your account can also provide you with your routing number. It’s often listed in the account information or settings section.

Can I determine a bank from a routing number?

ABA Search: If you have a routing number and need to find out which bank it belongs to, you can use an ABA search tool. These tools allow you to input a routing number to retrieve the bank’s name.

Bank’s address: Some ABA search tools also provide the bank’s address and sometimes contact information, making it easier to verify if you’re dealing with the correct institution.

How do I verify my account and routing number?

Routing Number Lookup Tool: To ensure the routing number you have is accurate, use a routing number lookup tool. These tools compare the number you provide against a database of known ABA routing numbers to confirm its validity.

Financial institution’s website: Another reliable method is to check directly on the financial institution’s website. If you know the bank’s name, go to their official site to find their listed routing numbers. This can be especially helpful if the bank operates in multiple regions with different routing numbers.

NachaTech: For businesses and individuals looking for a more comprehensive solution, NachaTech offers an ABA number validation tool. This tool not only validates the routing number but also provides additional security features to prevent fraud and ensure that your transactions are compliant with financial regulations.

Using the correct ABA routing number is crucial for any electronic transaction, be it direct deposits, wire transfers, or automatic bill payments. Misplacing even a single digit can send your money astray. By utilizing the resources mentioned above, you can ensure that your financial transactions are both secure and efficient.

Moving forward, understanding the importance of secure transactions and how ABA numbers play a role in this will help you navigate the financial world with confidence.

Ensuring Secure Transactions with ABA Numbers

When it comes to moving money, whether you’re paying a bill online, receiving a direct deposit from your employer, or sending a wire transfer, the security of the transaction is paramount. ABA numbers are at the heart of this security, acting as a financial GPS that ensures your money reaches its intended destination safely. Let’s break down how ABA numbers secure different types of transactions:

Wire Transfers

When you send a wire transfer, the ABA number is like the address that tells the banking system exactly where your money needs to go. It’s crucial because wire transfers are fast and often involve large amounts of money. A wrong ABA number could mean your money ends up in the wrong account, and retrieving it can be a nightmare.

Direct Deposits

For direct deposits, the ABA number ensures your paycheck lands in your account without any detours. It’s a set-it-and-forget-it kind of deal; once the correct ABA number is provided, your funds should arrive in your account like clockwork.

Electronic Payments

Paying bills online or transferring money between accounts requires the correct ABA number for smooth transactions. It’s what tells the electronic payment systems where to send or pull funds from, making your life a lot easier.

Fraud Prevention

Here’s where things get really important. The correct use of ABA numbers isn’t just about ensuring your transactions go smoothly; it’s also a critical component of fraud prevention. By using the right ABA number, you’re making sure that your money is going to a legitimate and correct account. It’s a simple step that can prevent a lot of headaches and heartaches caused by fraudsters.

How to Keep Your Transactions Secure:

- Double-check the ABA number before making any transaction. A simple mistake can cause big problems.

- Use trusted ABA number validation tools like NachaTech. These tools can verify that the ABA number you’re using is correct and up-to-date.

- Be wary of scams. Never give out your ABA number unless you’re sure of the transaction and the other party involved.

ABA numbers are not just numbers; they’re your first line of defense in the digital finance world. By ensuring that these numbers are correct for every transaction, you’re taking a big step towards safeguarding your money. In the realm of digital finance, a little diligence goes a long way in preventing fraud and ensuring that your transactions are secure.

Conclusion

In our journey through financial transactions, we’ve uncovered the critical role that ABA numbers play. These aren’t just sequences of digits; they’re the backbone of ensuring that every transaction reaches its intended destination safely and accurately. But, as we’ve seen, merely knowing an ABA routing number isn’t enough. The real power lies in validating these numbers effectively, a task that’s become increasingly complex in today’s digital age.

This is where the importance of an accurate ABA number validation tool cannot be overstated. It’s not just about preventing errors; it’s about building a foundation of trust and security in every transaction. Whether it’s a wire transfer, direct deposit, or electronic payment, the assurance that comes from knowing you’re using the correct ABA number is invaluable.

Enter NachaTech, a beacon in the murky waters of financial transactions. With their sophisticated ABA number validation tool, NachaTech isn’t just another service provider; they’re your partner in ensuring that each penny reaches its rightful place without the detours of fraud or error. Their tool isn’t just a layer of security; it’s a shield that guards against the complexities and vulnerabilities inherent in the digital finance ecosystem.

By choosing NachaTech, you’re not just choosing a tool; you’re choosing peace of mind. You’re ensuring that your transactions are not just fast but are also secure and accurate. When financial fraud seems to be always one step ahead, NachaTech provides the assurance that your transactions are protected, validated, and verified.

In conclusion, the journey through ABA numbers and their validation has shown us the undeniable truth: in the realm of digital finance, accuracy is everything. An effective ABA number validation tool isn’t just a nice-to-have; it’s a must-have. And with NachaTech, you’re equipped with more than just a tool; you’re empowered with a solution that stands as a vigilant guardian of your financial transactions.

As we move forward in this digital age, let’s not forget the importance of diligence and accuracy in every transaction we make. Let NachaTech be your ally in this journey, ensuring that every transaction you make is not just a transfer of funds but a testament to the security and integrity of your financial operations.