Overview of NACHA and ACH:

- NACHA (National Automated Clearing House Association) provides the framework that governs the ACH network.

- ACH (Automated Clearing House) network is an electronic system facilitating the transfer of funds between financial institutions in the United States.

- A NACHA ACH File, following NACHA’s standardized file format, sets out the instructions for initiating batches of ACH payments.

Are you feeling overwhelmed with the increasing ACH payment rejections? Are errors in your NACHA files causing unnecessary disruption in your financial workflow? Well, you’re not alone. Many businesses are encountering obstacles with their NACHA files that hamper the smooth flow of ACH payments. But, this doesn’t have to be the case.

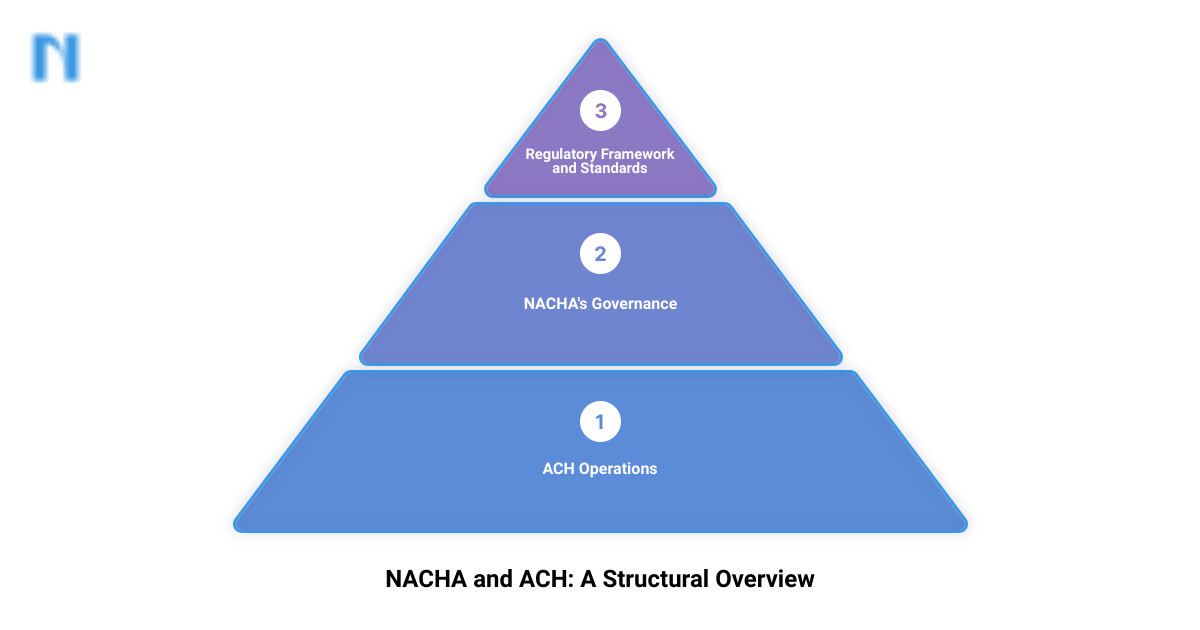

Introduction to NACHA and ACH

In the increasingly digital world of financial transactions, two terms continuously make their appearances – NACHA (National Automated Clearing House Association) and ACH (Automated Clearing House). The relationship between the two, while intertwined, often leads to confusion.

So, what exactly is NACHA and why is it pivotal? And how does ACH operate under NACHA’s governance? These questions are fundamental to understand for businesses seeking to seamlessly facilitate ACH payments.

Understanding NACHA and its Role

NACHA is primarily a governing institution that sets forth rules, guiding smooth, secure, and efficient monetary exchanges across the ACH network – a system that moves electronic payments from one bank to another.

What is ACH and How it Works

ACH, an integral aspect of today’s digital economy, is the electronic highway for money transfers between banks. It eliminates the need for paper checks and ensures faster, more efficient transactions.

The Relationship Between NACHA and ACH

NACHA and ACH are essentially part and parcel of the same ecosystem – with NACHA playing the role of the rule-setter and ACH being the platform where the rules are followed for transaction purposes.

Stay with us as we delve deeper into the intricate world of NACHA files and ACH payments, with the primary focus being the crucial NACHA ACH format.

Understanding the NACHA ACH File Format

To navigate the complex landscape of ACH payments, understanding the NACHA ACH file format is crucial. This file format forms the backbone of a multitude of transactions, from B2B payments to direct deposits.

The Structure of a NACHA ACH File

An ACH file is essentially a fixed-width ASCII file, each line of which is 94 characters long. Every line or ‘record’ in the file serves a specific purpose and adheres to a particular order to ensure a smooth processing. It’s like a well-rehearsed dance, where every move is meticulously planned and executed. The dance begins with the ‘File Header Record’ and ends with the ‘File Control Record’.

In between, you’ll find multiple ‘Batch Header Records’ and ‘Entry Detail Records’. Each of these records plays a specific role, ensuring the seamless transfer of funds between accounts. To make sure these steps are followed correctly, we provide tools that allow you to edit and validate ACH files with major errors.

The Importance of the NACHA ACH File Format

The NACHA ACH file format is not just about the technicalities; it’s about the efficiency and security it brings to financial transactions. Its standardized codes and specific record sequence promote uniformity, bolster security, and foster efficiency in monetary exchanges.

As we traverse the digital age, understanding the NACHA ACH file format has become a necessity. With billions of transactions being performed using the ACH standard, the importance of getting these files right cannot be overstated. This is the key to successful financial transactions – a mastery of the tools and systems that facilitate them.

The Role of Standard Entry Class (SEC) Codes in NACHA ACH Files

In a NACHA ACH file, the SEC Codes play a vital role. They are used to identify the payment type in the batch, such as whether it’s a direct deposit or a debit. SEC Codes ensure that each transaction is categorized correctly, thereby helping to maintain accuracy and integrity in the payment process.

In conclusion, mastering the NACHA ACH file format can be a game-changer in the intricate world of financial transactions. As we move towards an increasingly digital future, businesses that understand its structure, can utilize the right tools, like ours at NachaTech, to manage it and are poised to thrive in the evolving landscape of financial transactions.

How to Create a NACHA ACH File

When it comes to creating a NACHA ACH file, there are several methods available. Your choice will largely depend on your level of technical expertise, available resources, and comfort with manual or automated processes.

Manual Creation of NACHA ACH Files Using Excel or Quickbooks

One way to create a NACHA file is to use Excel or Quickbooks. This method is manual and requires some degree of coding knowledge.

Let’s start with Excel. You first create an Excel file with all necessary code fields filled out. This process is then followed by formatting the file so it can be converted into a NACHA file. The Premier ACH, a product used by banks, can convert an Excel file into a NACHA file, which typically starts with the creation of an XML file.

Quickbooks, on the other hand, involves using a third-party file conversion tool. You upload bank account information and invoices to be sent via email. Quickbooks processes payments from various sources, creating a NACHA file that’s automatically transferred to banks.

While these manual methods can work, they are time-consuming and prone to human errors.

Automated Creation of NACHA ACH Files Using Software Tools

For those who prefer a more streamlined and efficient approach, there are automated software options available. These tools, such as AP Automation software, provide an efficient way to process and pay all of your invoices, including batch ACH payments. This software sends NACHA files directly to your bank for payment and also records the payment into your accounting system through a bi-directional sync.

Another viable method is Payment Automation software. This type of software consolidates all your different payment methods into a single electronic file, saving your organization time and reducing the risk of fraudulent activity.

The Role of NachaTech in Editing and Validating NACHA Files

Once your NACHA file is created, it may need to be edited or validated. This is where we at NachaTech come in. Our software application assists financial institutions by validating NACHA files and eliminating potential rejections due to errors.

NachaTech provides features to generate reversal ACH files or correction ACH files. You can also use our command-line tool to bulk update certain data elements in the ACH file, minimizing the risk of errors.

Our solution enables you to automate ACH validation, ensuring that your ACH files meet the required standards and guidelines. This greatly reduces the risk of rejections, improving the efficiency and reliability of your financial transactions.

In summary, creating NACHA ACH files can be done manually or with automated software tools. However, for the sake of efficiency, accuracy, and ease, we at NachaTech recommend using an automated solution. By employing the right tools and processes, you can simplify the creation, editing, and validation of NACHA files, ensuring a smoother financial transaction process.

The Benefits and Challenges of Using NACHA ACH Files

Managing financial transactions is an intricate process, and when it comes to ACH payments, the NACHA ACH format plays a critical role.

The Advantages of Using NACHA ACH Files for Payments

NACHA ACH files offer an array of benefits for businesses, particularly when it comes to B2B transactions. Here are some key advantages:

-

Efficiency and Cost-effectiveness: ACH transactions are processed in batches, making them more economical compared to individual transactions. By utilizing NACHA ACH format, businesses can execute fast, cost-effective, and secure ACH payments.

-

Reduced Error Rates: The NACHA file format incorporates regulatory requirements and guidelines established by the National ACH Association, ensuring compliance with industry standards and reducing the risk of errors.

-

Enhanced Security: This file format adheres to robust security standards, providing secure transmission and encryption of payment data. This helps to reduce the risk of fraud.

-

Automation: Many financial institutions and software solutions, such as ours at NachaTech, automate the creation, editing, and validation of NACHA files, reducing manual intervention and the potential for human error.

Common Challenges and How to Overcome Them

Despite these advantages, using NACHA ACH file format can present certain challenges. One of the main issues is the complexity of creating and editing NACHA files. If done manually, this can be a time-consuming process prone to errors. Moreover, any errors in the NACHA file can lead to ACH payment rejections, causing financial loss and potential damage to a business’s reputation.

So, how can you overcome these challenges? The answer lies in using automated tools for creating, editing, and validating NACHA files. At NachaTech, we provide a solution that can open and edit ACH files with major errors, offer raw line editing, and provide fast validation of ABA numbers. This helps to ensure the integrity of your NACHA files, resulting in smoother, error-free ACH transactions.

In the end, the benefits of using the NACHA ACH format far outweigh the challenges, especially when you have the right tools in place to manage the process efficiently and accurately.

Understanding NACHA ACH Transaction Codes

Decoding the intricate world of financial transactions can be daunting. But with a solid understanding of the language used in these transactions, it becomes a lot easier. Here, we’ll delve into NACHA transaction codes, a crucial element in the nacha format ach.

The Purpose of NACHA Transaction Codes

Every financial transaction within a NACHA file is guided by a unique set of codes known as transaction codes. These two-digit identifiers provide essential information about the type of account involved (checking or savings), the type of transaction (debit or credit), and the destination of the transaction (consumer or corporate).

These codes are crucial in ensuring error-free financial transactions. They serve as the DNA of an ACH file, defining its unique identity and functionality.

Different Types of NACHA Transaction Codes and What They Mean

Let’s breakdown a few examples of NACHA transaction codes:

- A transaction code of ’22’ indicates a credit to a checking account.

- A ’27’ signifies a debit from a checking account.

Understanding these codes is a vital step in ensuring smooth financial transactions. Each transaction code has a specific purpose, and knowing how to use them correctly can be the difference between a successful transaction and a labyrinth of errors and rejections.

In addition to transaction codes, there are also service class codes in ACH files. These three-digit codes determine the type of entries included in a batch. For instance, a service class code of ‘200’ indicates that the batch contains mixed entries, ‘220’ signifies that the batch includes only ACH credits, and ‘225’ means the batch consists only of ACH debits.

These codes are vital in organizing and categorizing transactions within an ACH file, ensuring a streamlined and organized processing of financial transactions.

At NachaTech, we understand the complexity of these codes and have designed our software to help users navigate them effectively. Our tool aids in the editing and validation of ACH files, enabling users to manage these codes with ease and accuracy. By providing the ability to edit and validate ACH files with major errors, and offering features like raw line editing and fast validation of ABA numbers, we simplify the once daunting task of ACH file management.

The key to successful financial transactions lies not just in the transactions themselves, but in the mastery of the tools and systems that facilitate them. And that’s why understanding the NACHA ACH transaction codes is so crucial. Here’s to mastering ACH files, eliminating payment rejections, and driving your business towards financial success.

Upcoming Changes to NACHA ACH Rules in 2021

As we continue to adapt to the evolving digital landscape, it’s important to stay informed about the changes in the NACHA ACH rules that will impact how we manage financial transactions. In 2021, two significant changes are set to be implemented: the extension of the Same Day ACH window and the mandatory account validation for WEB debits.

Extending the Same Day ACH Window

One of these changes is the extension of the Same Day ACH window of operations. This rule will add two additional hours to the banking day, creating a new third window that will close at 4:45 p.m. ET. This extension is particularly beneficial for financial institutions on the west coast, allowing them to process returns later in the day. As the current 4 p.m. window is rolled into this later window, all banks will have more flexibility in their operations, resulting in smoother and more efficient transactions.

This change not only improves the efficiency of the ACH network but also increases its reliability. By extending the Same Day ACH window, NACHA aims to provide a more robust and resilient system that benefits businesses and consumers alike.

Mandatory Account Validation for WEB Debits

The second notable rule coming into effect on March 19, 2021, is the requirement for account validation as part of a “commercially reasonable fraudulent transaction detection system” when screening WEB debits. This rule applies whenever an account number is used for the first time or when any changes are made to existing ones.

This new rule reinforces the importance of due diligence in verifying account information to prevent fraudulent transactions. It’s essential to note that the rule remains neutral regarding the specific methods or tools required for account validation. This flexibility allows businesses to choose the best account validation solutions that suit their operations.

At NachaTech, we understand the importance of these changes and are committed to helping our clients navigate them. Our advanced tools are designed to facilitate seamless transitions, ensuring your business remains compliant with the latest NACHA ACH rules.

These changes underline NACHA’s commitment to maintaining the integrity of the ACH network and protecting the interests of businesses. Being aware of these changes and understanding their implications is key to staying ahead in the evolving financial landscape.

Conclusion: The Future of NACHA ACH Payments

As we look towards the future, it is clear that the role of NACHA ACH payments is set to grow and evolve. The ACH network, governed by NACHA, is becoming more integral in financial transactions, especially in the realm of business-to-business payments.

There are many reasons why businesses are increasingly turning to ACH payments. The cost-effectiveness and efficiency of batch processing in the NACHA format ACH, the speed of electronic payments, and the reduced chances of human error are just a few of the benefits. Also, the ability to automate recurring payments ensures transactions are executed in a timely manner without the need for manual intervention.

As we ride the wave of digital transformation, the process of creating and validating NACHA files is becoming increasingly automated. At NachaTech, we are developing tools and software to streamline this process, eliminating the need for manual intervention, and increasing the efficiency of financial transactions.

In the coming year, NACHA plans to implement new rules that will affect how organizations do business. For instance, the extension of the Same Day ACH window will add two additional hours to the banking day, a change that will be particularly beneficial for west coast financial institutions.

Another significant change is the mandatory account validation for WEB debits, which is part of a “commercially reasonable fraudulent transaction detection system”. This rule will come into effect on March 19, 2021, and underscores NACHA’s commitment to maintaining the integrity of the ACH network and protecting businesses’ interests.

These developments point to a future where NACHA ACH payments play an even more central role in business transactions. By staying informed about these changes and leveraging tools like those offered by NachaTech, businesses can position themselves for success in the evolving landscape of financial transactions.

In conclusion, the future of NACHA ACH payments looks promising, with advancements geared towards increasing efficiency, reducing fraud, and improving transaction speed. NachaTech is committed to supporting businesses in navigating these changes and unlocking seamless transactions.

For more insights and solutions related to NACHA ACH payments, please consider reading our blog or exploring our range of features.

Thank you for joining us on this journey to understand and utilize the NACHA format ACH to its fullest potential. We look forward to supporting you in the future of ACH payments.