If you’re looking to understand the ACH file format, here’s a quick primer:

– ACH stands for Automated Clearing House, a network that facilitates electronic money transfers.

– NACHA (National Automated Clearing House Association) governs the ACH network, setting the rules for ACH transactions.

– An ACH file contains detailed instructions for performing batched money transfers among banks or financial institutions.

– The NACHA file format is standardized to ensure secure and efficient transactions across this network.

When financial transactions pulse through the heart of businesses daily, understanding the Automated Clearing House (ACH) file format becomes essential. Imagine ACH as the road network that connects every bank and financial institution within the United States, allowing for the smooth transit of funds from one place to another. NACHA is the traffic authority, setting the rules and standards to ensure every transaction reaches its destination swiftly and securely.

Businesses and financial institutions grapple with the challenges of ensuring their transactions navigate this network without hiccups—errors in ACH files can result in payment delays or rejections, disrupting cash flows and operations. Leveraging software solutions that can validate and edit files to conform to NACHA standards becomes not just beneficial, but, for many, indispensable.

Understanding ACH and NACHA

When we talk about moving money in the US, two terms often come up: ACH payments and NACHA file format. Let’s break these down into simple language.

ACH payments are like the electronic version of a check. Instead of writing a paper check, your bank sends a digital message to another bank. This message says, “Hey, move this amount of money from my account to this other account.” It’s quick, it’s electronic, and it’s used for all sorts of payments – from your paycheck deposit to paying your electric bill online.

Now, for all these digital messages to be understood by any bank in the country, there needs to be a common language. This is where NACHA comes in. NACHA stands for the National Automated Clearing House Association. Think of NACHA as the grammar teacher for banks, ensuring they all speak the same financial language.

The NACHA file format is the specific set of rules or grammar that banks follow when they send these ACH payment messages. It’s like a template that ensures every bank’s messages are clear and can be understood by any other bank they’re sent to. This format includes specific sections for the sender’s information, the receiver’s information, and the transaction details, all wrapped up in a fixed-length, 94-character line.

Electronic funds transfers (EFTs) are a big category of money-moving methods that include ACH payments. While there are many ways to transfer funds electronically, ACH is one of the most common in the U.S., thanks to its efficiency and cost-effectiveness.

The Automated Clearing House Association (that’s what ACH stands for) is the network that these electronic messages travel across. It’s a bit like the internet, but instead of carrying tweets, videos, or emails, it carries requests to move money. This network processes billions of transactions every year, making it a backbone of the American financial system.

In summary, when we talk about ACH and NACHA, we’re talking about the system and rules that allow banks to move money electronically on behalf of businesses and individuals. This system makes it possible for you to get paid, pay your bills, and transfer money without ever touching a piece of paper money or writing a check. And the NACHA file format is the key to making sure all those transactions are done smoothly and securely.

In the next section, we’ll dive into the structure of an ACH file, examining its critical components and why each matters for secure and efficient transaction processing.

Structure of an ACH File

Understanding the ACH file format can seem like decoding a secret message at first. But don’t worry, it’s simpler than it looks. Let’s break it down, piece by piece.

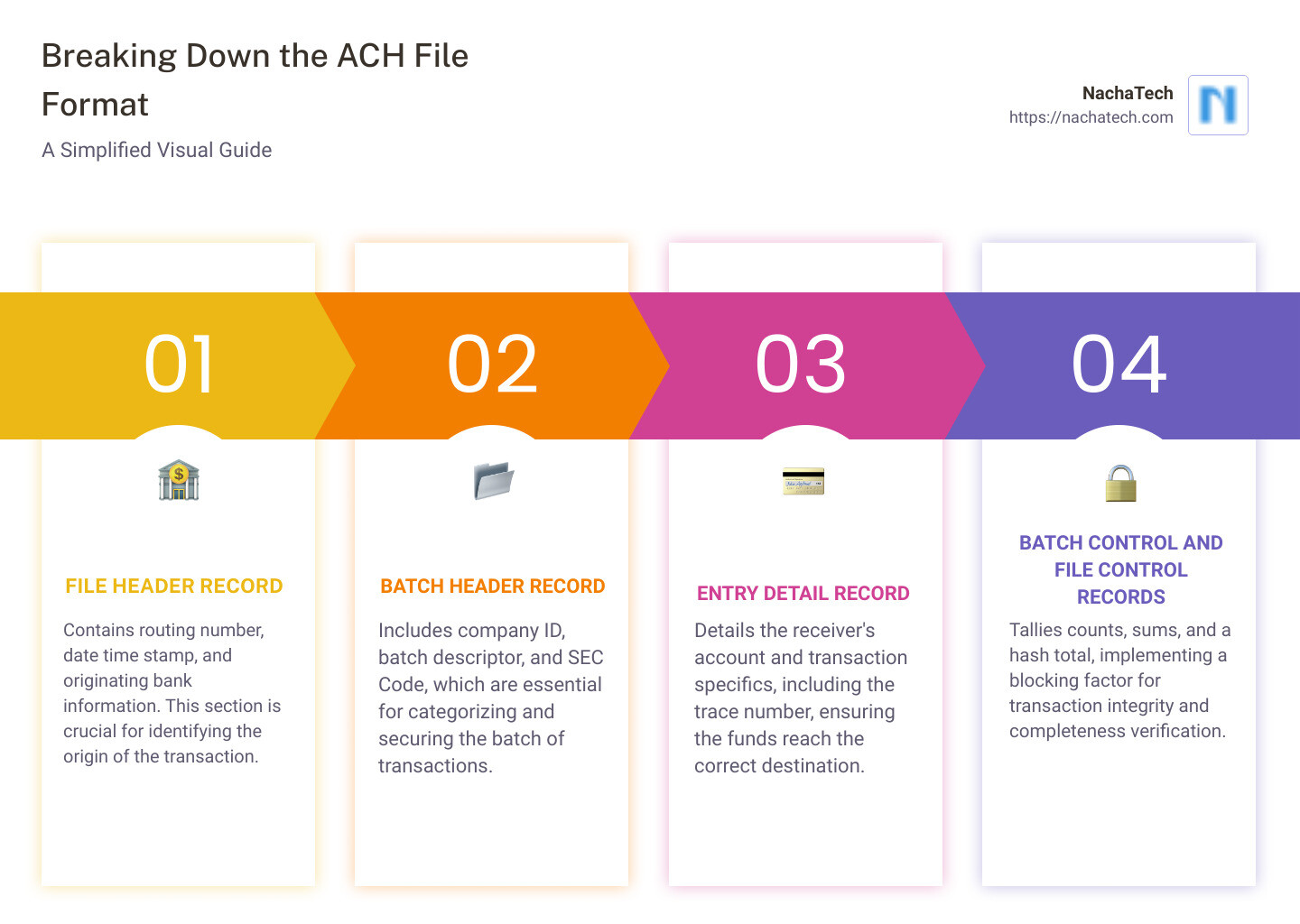

File Header Record

Think of the File Header Record as the introduction to a book. It tells you the basics: where the ACH file is coming from, when it was sent, and who sent it. This part of the file starts with a routing number—like a home address for the bank sending the money. Then there’s a date time stamp, marking exactly when the file was created. And, of course, the originating bank—the bank that’s kicking off this whole process.

Batch Header Record

Moving on, the Batch Header Record is like the start of a new chapter in our book. It groups transactions together that have something in common. This could be the company ID, a unique identifier for the company moving money, the batch descriptor (think of it as a label for the batch), and the SEC Code, which tells us the type of transactions in the batch. This organization makes processing smoother and more efficient.

Entry Detail Record

Next up, the Entry Detail Record. This is where the action happens. Each record contains details about a single transaction. You’ll find the receiver’s account info here, the transaction details (like how much money is moving), and a trace number. This number is super important because it’s like a tracking number for a package; it helps follow the transaction from start to finish.

Batch Control and File Control Records

Finally, we reach the Batch Control and File Control Records. These are like the summary at the end of a chapter and the conclusion of our book, respectively. They provide an overview of what happened: counts (how many transactions there were), sums (total amounts of money moved), and a hash total (a number that helps verify that all the data is correct). The blocking factor is also mentioned here, ensuring that the file meets specific formatting requirements for processing.

Each line in an ACH file is exactly 94 characters long and follows a fixed-width, ASCII format. This strict structure ensures that every transaction is processed correctly and securely, no matter where it’s going or coming from.

Understanding the ACH file format is crucial for anyone dealing with electronic payments. It’s the backbone of the ACH Network, ensuring that your money moves smoothly and securely from one account to another. With this guide, you’re now better equipped to navigate ACH transactions.

How to Create and Upload an ACH File

Creating and uploading an ACH file might sound complicated, but it’s a straightforward process once you understand the steps and tools involved. Let’s break it down.

Tools for Creating ACH Files

When it comes to creating ACH files, several tools are designed to make the process as painless as possible. These tools cater to different needs, from small businesses to large enterprises, ensuring there’s a solution for everyone.

- Treasury Software: A standout option for its ease of use and powerful features. Treasury Software allows you to create ACH files directly from your accounting or payroll data. It’s a great choice if you’re looking for a tool that can handle complex payment scenarios without requiring a deep technical understanding.

- Premier ACH: Ideal for businesses that are already using Excel for their financial management. Premier ACH can convert Excel files into ACH files, simplifying the transition from manual to electronic payments. It’s a two-step process that transforms your Excel data into a format ready for bank submission.

- Electronic Bank Payments SuiteApp: Specifically designed for NetSuite users, this tool integrates seamlessly with your existing ERP system. It automates the creation of ACH files based on your payable and receivable transactions within NetSuite, streamlining your payment processes.

- QuickBooks Integration: For those already using QuickBooks for accounting, integrating ACH payment processing is a logical step. QuickBooks offers solutions that generate ACH files from your existing payment data, making it easy to transition to electronic payments without disrupting your workflow.

File Upload

Once you’ve created your ACH file using one of the tools mentioned above, the next step is to upload it to your bank. This is typically done through your bank’s online portal. Here’s a simplified overview:

- Log in to your bank’s portal: Use your credentials to access the payment or ACH file upload section.

- Select the ACH file: Find the ACH file you created on your computer and select it for upload.

- Verify and submit: Before submitting, double-check the file for any errors. Once you’re sure it’s correct, submit the file for processing.

Bank Portal

Your bank’s portal is not just for uploading ACH files. It’s also where you can manage and monitor all your electronic payments. Most portals offer detailed reporting tools, allowing you to track the status of each payment, view processing times, and identify any issues that may arise.

Activation Code

In some cases, especially when setting up ACH payments for the first time, your bank may require an activation code. This is a security measure to ensure that only authorized users can create and submit ACH files. If required, your bank will provide you with this code, which you’ll enter into the bank’s portal or your ACH file creation tool.

Creating and uploading ACH files doesn’t have to be daunting. With the right tools and a basic understanding of the process, you can streamline your payment operations, reduce manual errors, and improve your overall financial workflow. Whether you’re a small business or a large corporation, the move to electronic payments is a step toward greater efficiency and security in your financial transactions.

Common Issues and Solutions

When dealing with ACH file format, a few common issues can pop up, often leading to headaches and delays. But don’t worry; for every problem, there’s a solution. Let’s dive into some of these challenges and how you can solve them.

Manual Errors

The Problem: Manual errors are the bane of financial transactions. A typo in an account number or an incorrect dollar amount can lead to failed transactions, delays, and unhappy vendors or customers.

The Solution: Automation is key. Tools like NachaTech can help reduce the risk of manual errors by automating parts of the ACH file creation process. By pulling data directly from your accounting software, these tools ensure that numbers are accurate and up-to-date.

Standardization

The Problem: ACH files need to follow a strict format, but with so many details to get right, it’s easy to make a mistake. Without standardization, files might be rejected, causing delays and frustration.

The Solution: Use specialized software designed for creating ACH files. These programs understand the ACH file format requirements and guide you through the process, ensuring that every file you create meets the necessary standards. This not only saves time but also minimizes the risk of rejection.

Validation

The Problem: Even if you think you’ve done everything right, there’s always a chance of errors slipping through. Submitting an ACH file without validating it first is like crossing the street without looking both ways—risky.

The Solution: Before submitting your ACH file, use a validation tool. NachaTech, for example, offers features to edit and validate your ACH files. These tools check for common errors and inconsistencies, giving you a chance to fix them before they cause problems. Think of it as a final safety check before your file goes live.

NachaTech

The Solution in Detail: NachaTech isn’t just a solution; it’s a comprehensive approach to handling ACH files. With features for creating, validating, and even fixing errors in your ACH files, it acts as a one-stop-shop for all things ACH. By integrating NachaTech into your payment processing workflow, you can significantly reduce the likelihood of errors and streamline your operations.

In Summary

Dealing with ACH file format doesn’t have to be a struggle. By recognizing the common issues and implementing the right solutions, you can make the process smoother and more reliable. Automation, standardization, and validation are your best tools in this endeavor, and solutions like NachaTech can provide all three. With these strategies in place, you can focus less on fixing errors and more on growing your business.

Moving forward, it’s also helpful to keep in mind the Frequently Asked Questions about ACH File Format. Knowing the answers to these questions can further demystify the process and help you avoid common pitfalls.

Frequently Asked Questions about ACH File Format

What is the difference between ACH and NACHA?

ACH stands for Automated Clearing House. It’s a network used for electronically moving money between bank accounts across the United States. Think of it as the digital highway your money takes when it’s being sent from one bank to another.

NACHA manages this highway. It’s like the traffic controller for ACH payments. NACHA sets the rules and standards for how money should safely and efficiently travel on this highway from one bank to another.

How do I correct errors in an ACH file?

Correcting errors in an ACH file can feel tricky, but it’s not impossible. If you spot an error before the file is sent to the bank, you can usually fix it directly in the file. This might involve updating account numbers, adjusting dollar amounts, or correcting routing numbers.

If the file has already been sent, things get a bit more complicated. You might need to contact your bank or payment processor. They can guide you on how to submit a corrected file or, in some cases, reverse the transaction.

The key is to act quickly. The sooner you spot and report an error, the easier it is to correct.

Can ACH files be edited after submission?

Once an ACH file is submitted, it generally cannot be edited. The ACH network processes payments in batches, and once your file is in the mix, it’s on its way. If you need to make changes, you’ll likely have to wait until the transaction is processed.

In some cases, if you catch the error fast enough, your bank might be able to stop the transaction before it’s fully processed. But this isn’t always guaranteed. It’s much safer to double-check your ACH files for accuracy before submitting them.

If an error slips through, you may need to process a separate transaction to correct it. This could be a reversal, return, or a new payment to offset the mistake. Your bank or payment processor can advise on the best action based on the type of error and when it was discovered.

Understanding the ACH file format and knowing how to navigate common issues can save you a lot of time and headache. Mistakes happen, but with the right knowledge, they can often be quickly resolved. Keep these FAQs in mind as you work with ACH payments to make the process as smooth as possible.

Conclusion

In financial transactions, the ACH file format stands out as a backbone for countless payments and money transfers. It’s a system that, while complex, facilitates the smooth flow of billions of dollars every day. Understanding this format isn’t just a technical necessity; it’s a business imperative.

Streamlining payments is not just about moving money from point A to point B. It’s about doing so efficiently, securely, and reliably. This is where the ACH network shines, offering a cost-effective and time-saving method for businesses to manage their payments. Whether it’s payroll, vendor payments, or customer refunds, the ACH network provides a streamlined solution.

Enter NachaTech. This tool represents a significant leap forward in managing ACH files. It’s not just about creating or editing these files; it’s about ensuring they are error-free and compliant with the latest standards. NachaTech simplifies what was once a daunting task, making it accessible even to those who might not have a deep technical background in finance. With features like raw line editing and fast validation of ABA numbers, NachaTech is akin to having a financial expert by your side, ensuring your ACH files are in perfect shape.

The importance of the ACH file format cannot be overstated. In a digital age where financial transactions are increasingly moving online, having a solid grasp of this format is crucial. It’s not just about avoiding errors or rejections; it’s about leveraging the capabilities of the ACH network to enhance your business operations. Successful ACH transactions mean happy vendors, satisfied employees, and content customers.

As we look to the future, the role of ACH files and the technology that supports them, like NachaTech, will only grow in importance. The financial landscape is evolving, with a push towards greater automation and efficiency. Tools that can streamline the ACH file creation and management process will be invaluable.

In conclusion, mastering the ACH file format is more than a technical skill—it’s a strategic advantage. With the right tools and understanding, businesses can transform their payment processes, making them more efficient, secure, and reliable. Let’s embrace the future of financial transactions with confidence, knowing that we have the knowledge and technology, like NachaTech, to support our journey.