Introduction to ACH File Processing

Are you continually grappling with ACH payment rejections that are compromising your cash flows and potentially straining your business relationships? If so, improved ACH file processing could be the lifeline your business needs.

ACH file processing sits at the heart of today’s digital economy. ACH, or Automated Clearing House, is the underlying structure that supports monetary transfers between banks while eliminating the need for paper checks and manual labor. Yet, mastering this process may seem daunting with its complex file structures and strict data specifications.

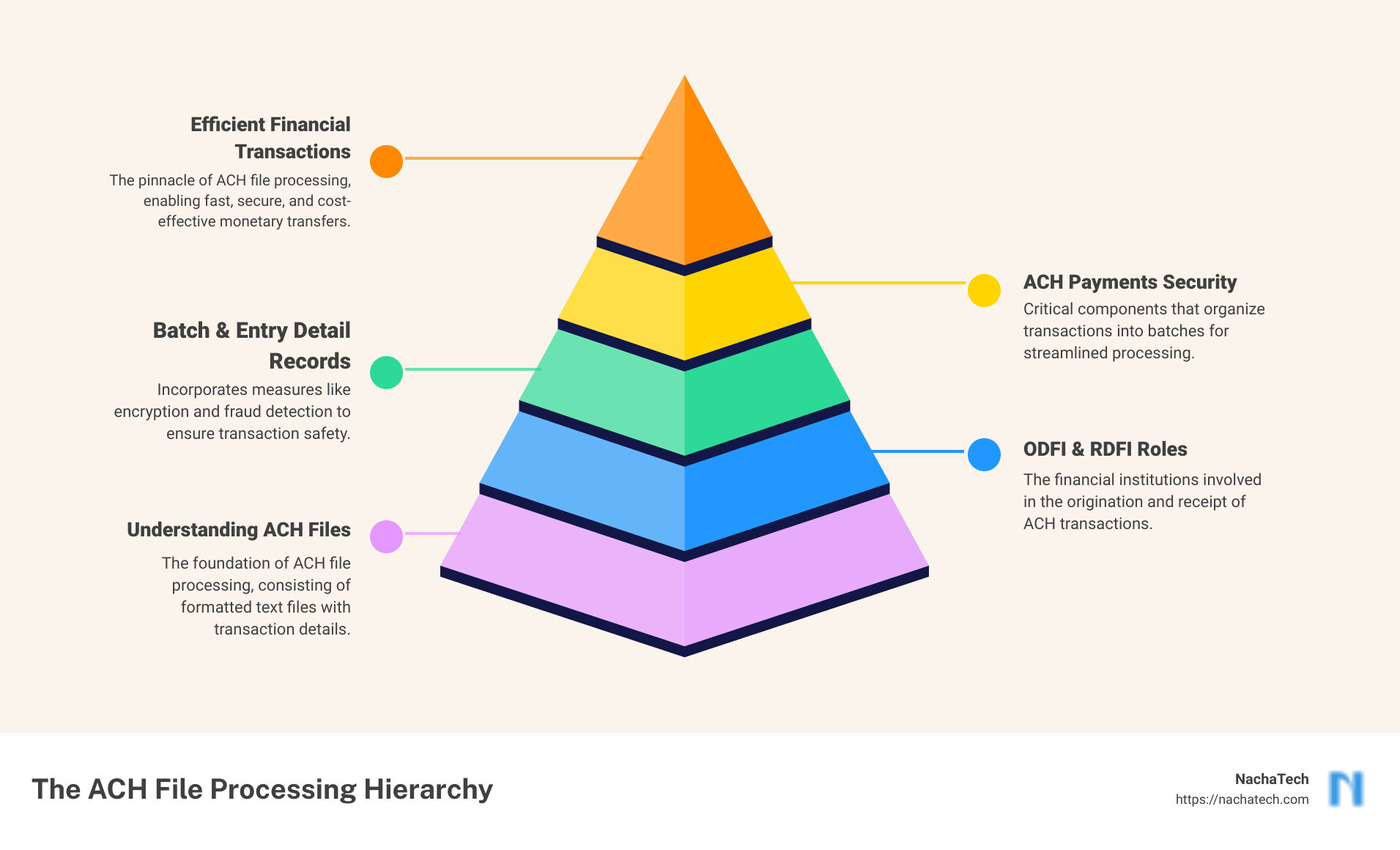

Structured Information Snippet: ACH File Processing Essentials:

- What is an ACH File? An Automated Clearing House (ACH) file is an ASCII file format that holds the required details for money transfers between banks.

- What is the ACH Process? The ACH process refers to the electronic method used for transferring money from one bank account to another, typically through Direct Payments.

- Why is ACH File Processing Important? ACH file processing ensures faster, cheaper, and more efficient transactions between financial institutions. It is the backbone of digital payments.

As we dive deeper into the realm of ACH file processing, we’ll shed light on the process, unravel the role of the Originating Depository Financial Institution (ODFI), and highlight why mastering this process is integral to financial transactions. Armed with a solid understanding, you will be better equipped to tackle ACH file processing and turn it into an asset for your business, enhancing efficiency, cost-effectiveness, and reliability in your ongoing financial operations.

Understanding the Structure of ACH Files

Before diving into the specifics of ACH file processing, it’s important to understand the basic structure of ACH files. An ACH file is a fixed-width, ASCII file, with each line (known as a “record”) exactly 94 characters in length. Each record is comprised of various “fields” at specific positions within that line.

The Basic Structure of ACH Files

An ACH file begins with a single “File Header Record,” identifiable by the digits “101,” followed by the routing number of the originating (sending) bank. This record sets the stage for the transaction, including the originating bank’s name, the company name, and a timestamp for the transaction.

Following the File Header Record, there are multiple “Batch Header Records” and “Entry Detail Records”. Each batch of transactions commences with a “Batch Header Record,” which describes the type (debits and/or credits) and purpose of all transaction entries within the batch. The “Entry Detail Records” hold the specifics of each transaction, such as the receiver’s account details, transaction amount, and type.

The Importance of File Header Record and File Control Record

These two types of records play a crucial role in the ACH file structure. The File Header Record not only signals the start of the file but also provides vital information that helps the Originating Depository Financial Institution (ODFI) recognize which client sent the particular file.

On the other hand, the “File Control Record,” identifiable by the digit “9,” marks the end of the file. This record contains various counts (number of batches, number of entries, etc.), sums (debit total and credit total), and a hash total to ensure that the file was generated correctly.

Understanding Batch Header Record and Batch Control Record

The Batch Header Record signifies the start of a new batch of transactions, identifying your company as the originator. This record also specifies the date the transactions are supposed to post in the Receiver’s account, providing a description for all the transactions in the batch.

The Batch Control Record, on the other hand, is the curtain call for each batch. It summarizes the transactions and ensures the integrity and correctness of the batch information.

The Role of Entry Detail Records in ACH Files

Beginning with a “6,” each “Entry Detail Record” contains information about the Receiver, including their account name and account number, as well as the transaction details, such as the amount and transaction type (debit or credit).

Understanding these basic structures of ACH files is the first step toward mastering ACH file processing. With a clear understanding of the structure, you can then leverage the right tools, like NachaTech, to manage and process your ACH files efficiently and accurately.

The Benefits of ACH Payments

ACH Payments have become a game-changer in the realm of financial transactions. They come with a host of benefits that make them a preferred choice for businesses and customers alike. These benefits range from efficiency and cost-effectiveness to security and reversibility. Furthermore, ACH transactions have lower failure rates, which helps in reducing customer churn.

Efficiency and Cost-Effectiveness of ACH Payments

One of the most significant advantages of ACH payments is their efficiency and cost-effectiveness. ACH transactions are processed in batches, which makes them more economical than individual transactions. This batch processing approach not only cuts costs but also saves time, providing businesses with a crucial advantage in today’s fast-paced environment. Moreover, ACH transactions eliminate the need for paper checks, reducing the chances of human error and streamlining the payment process. The ability to automate ACH payments means businesses can set up recurring payments, ensuring timely transactions without the need for manual intervention.

Security and Reversibility of ACH Payments

ACH transactions also offer an added layer of security. Unlike wire transfers which cannot be reversed, ACH payments are reversible, providing a safety net against fraud. The ACH network also authenticates users to prevent fraudulent transactions. Furthermore, the direct transactions between two parties with no mediator, make ACH payments more secure. This feature is especially beneficial for recurring payments, where the customer’s bank account information doesn’t need to be provided every time, reducing the chances of fraud and erroneous payments.

Lower Failure Rates and Reduced Customer Churn with ACH Payments

Another significant benefit of ACH payments is their low failure rates. Payments made with ACH have lower failure rates than those made with credit cards, which can expire leading to failed transactions. Since ACH payments are made directly from bank account to bank account, they reduce the chances of payment failure. This, in turn, leads to lower customer churn, as customers are less likely to stop using a service due to payment issues.

In conclusion, ACH payments offer a multitude of benefits that can significantly enhance your business operations. Their efficiency, security, and low failure rates make them an ideal choice for businesses. With the right tools, like our NachaTech software, you can leverage these benefits to their fullest, streamlining your financial transactions and improving your business performance.

How to Improve ACH File Processing with These 5 Easy Changes

Navigating ACH file processing may seem complex, but with a few simple changes, you can streamline the process and minimize errors. The following five steps provide a roadmap for improving your ACH file processing procedures.

Implementing Same Day ACH for Faster Funds Movement

In a fast-paced business environment, speed is paramount. Same Day ACH is a game-changer, enabling the processing of ACH transactions on the same day, ensuring quicker payments and improved cash flow. However, not all transactions qualify for Same Day ACH, and certain conditions need to be met. Implementing Same Day ACH where feasible can significantly accelerate your funds movement.

Ensuring Compliance with Data Specifications for Records

ACH files have specific data specifications that must be adhered to, such as specific rules for alphanumeric fields, numeric fields, and trace numbers. Ensuring compliance with these specifications can prevent errors and rejections while facilitating smooth ACH processing.

Utilizing Pre-notifications Before Initiating a Live Authorized Entry

Before initiating a live authorized entry, it’s recommended to send pre-notifications at least three business days in advance. This practice can help avoid any unexpected issues and ensure smoother ACH transactions.

Understanding and Applying the Correct Service Class Code

The Service Class Code in an ACH file identifies whether the batch contains debit transactions, credit transactions, or both. Understanding and applying the correct Service Class Code is crucial for accurate processing and avoids potential errors.

Using Software Applications like NachaTech for Editing and Validating NACHA Files

Finally, utilizing a reliable software solution like NachaTech can be a game-changer in your ACH file processing. Our software offers powerful features to edit and validate your NACHA files swiftly and accurately. It not only helps in identifying and resolving any errors that occur but also ensures smoother, more efficient ACH transactions.

By implementing these five changes, you can significantly improve your ACH file processing. Not only will these changes reduce the occurrence of errors and rejections, but they will also ensure more efficient and timely financial transactions.

The Future of ACH File Processing

As a key player in the financial sector, we at NachaTech are deeply invested in the future of ACH file processing. We’ve seen how ACH processing has evolved over the years, and we’re excited about the changes and improvements that are on the horizon.

Continuous Improvements in the ACH Network

The ACH Network is continuously evolving and improving. The National Automated Clearing House Association (NACHA) is committed to driving the ACH network forward and enhancing its reliability and safety. One such change is the extension of the Same Day ACH window, which will provide two additional hours for transactions. This is especially beneficial for financial institutions on the west coast that have been grappling with time zone differences.

In addition to extended hours, new rules are also coming into effect. In 2021, NACHA enforced a more rigorous account validation as part of a “commercially reasonable fraudulent transaction detection system” for screening WEB debits. This change emphasizes NACHA’s commitment to maintaining the integrity of the ACH network and protecting the interests of businesses.

The Impact of Expanded Operating Hours on ACH Processing

The expansion of the Same Day ACH window is a significant step towards improving the efficiency and convenience of ACH processing. With two additional hours for transactions, businesses and consumers will have more flexibility in initiating payments, leading to faster funds movement. This is particularly useful for organizations with high volumes of transactions or those that need to process payments late in the day.

The Role of Direct Deposit Payroll Payments in ACH Processing

Direct deposit payroll payments are a significant part of ACH processing. They offer a convenient, secure, and efficient method of transferring funds from businesses to their employees. With ACH direct deposit, payroll processing becomes quicker and more streamlined, reducing the chances of errors and delays.

In the future, we foresee an increase in the use of ACH direct deposit for payroll payments, driven by the convenience and efficiency it offers both businesses and employees. Additionally, as more businesses move towards digital solutions and away from traditional methods like paper checks, the role of ACH in payroll processing will only become more significant.

At NachaTech, we’re excited about the future of ACH file processing. We’re committed to staying abreast of the latest developments and providing our clients with the tools and resources they need to navigate the evolving landscape of financial transactions. As the ACH network continues to grow and evolve, we’ll be there every step of the way, providing the expertise and solutions you need to succeed.

Conclusion: Mastering ACH File Processing for Efficient Financial Transactions

As we’ve explored throughout this article, ACH file processing is a critical aspect of modern financial transactions. It underpins countless operations, from B2B payments to direct deposits, and its importance cannot be overstated.

The good news is, mastering ACH file processing isn’t as daunting as it may seem. With a few simple changes, your financial institution can significantly improve the efficiency and accuracy of its ACH transactions. Here’s a quick recap of the steps we’ve suggested:

- Implementing Same Day ACH for faster funds movement

- Ensuring compliance with data specifications for records

- Utilizing pre-notifications before initiating a live authorized entry

- Understanding and applying the correct Service Class Code

- Using software applications like NachaTech for editing and validating NACHA files

Incorporating these changes can help eliminate payment rejections, reduce errors, and streamline your financial transactions.

But mastering ACH file processing isn’t just about making changes to your current processes. It’s also about embracing the future of financial transactions. As we move into an increasingly digital age, the ability to understand and efficiently manage ACH files will become even more pivotal.

At NachaTech, we’re committed to helping our clients navigate this evolving landscape. We offer tools that simplify the process of managing ACH files, from editing to validation. Our ACH file editing software allows for raw line editing, fast validation of ABA numbers, and even the ability to correct major errors.

In addition, we provide resources and insights to keep you up-to-date with the latest developments in ACH processing. Our blog covers a range of topics, from understanding the ACH process to tips for maximizing the use of our software.

In conclusion, the key to successful financial transactions lies not just in the transactions themselves, but in the mastery of the tools and systems that facilitate them. With the right understanding and the right tools, you can master ACH file processing and drive your business towards financial success.

The future of financial transactions is digital. And with NachaTech, you’ll be well-equipped to thrive in this evolving landscape.

For further reading, check out our guide on understanding ACH file editing software and its benefits.

Thank you for joining us on this journey to mastering ACH file processing. Here’s to a future of seamless, efficient, and successful financial transactions.